Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up – there were a few 1% winners. Europe is currently mostly up – gains are small. Futures here in the States point towards a moderate gap up open for the cash market. This comes off a day the market gapped up and was strong early but then gave everything back plus some before closing flat.

There were many false breakouts yesterday – stocks and indexes which moved above previous highs only to get sold and close in the bottom half of their intraday ranges.

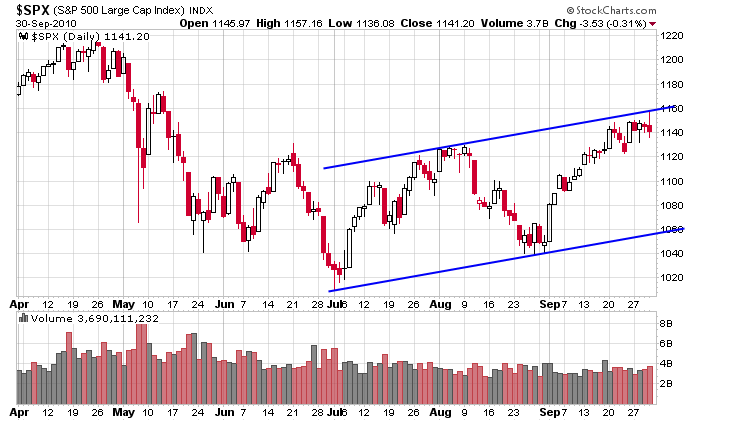

On an intermediate term basis, the trend remains up. On a short term basis, things are less clear. If we ignore yesterday’s early move up, the S&P is still trading in a range just under 1150 resistance, but we really can’t ignore the move. When patterns set up, they build energy – energy that helps push stocks forcefully through resistance levels and beyond. By moving up yesterday, some of that energy was used up – i.e. there’s less left for the next attempt. If there is a next attempt.

I still like the market to the long side, but in the near term I’m being much more cautious.

Here’s the daily SPX. There’s nothing overly bullish or bearish about the overall chart. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 1)”

Leave a Reply

You must be logged in to post a comment.

The historical bullish cycle is as follows: “that stocks tend to rise at an

above average rate in the two trading days preceding each market holiday

closing as well as on the last one or two trading days of each month and

during the first four or five trading days of each month.” (I have been

following this for the last 25 years and it works at least 80% of the time).

And for some unknown reason the Russell 2000 benefits the most from this. HW

A bell curve would be nice, for the two days before and five after month-end. I’m assuming this applies to the equity market indexes. An increase in price wouldn’t necessarily mean an increase in buying. It could be a decrease in selling in that the shakers are busy filling out month-end reports and don’t have time to trade. Did you track volume?

RichE: Volume used to be a major factor to the equity equation. Now with all the

computer buying and selling, I’m not sure volume is a major component anymore. HW

I find the spikes usefull.

However, we should be aware that the first few days of the new month can be strong, so there is a possibility for the market to rally for another day or two and then begin its decline.

Garrett Jones

Excellent prognosis….