Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up – China and Hong Kong gained 1%. Europe is currently down across the board. Futures here in the States point toward a small gap down open for the cash market.

Over the last month the only warnings signs given off where overbought conditions – situations that could be easily ignored. But now warning signs come in the form of some failed breakouts and leadership stocks pulling back – situations harder to ignore.

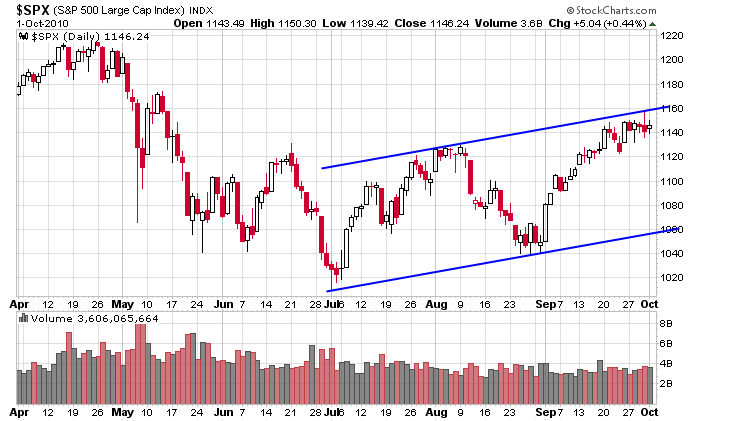

The intermediate term trend remains up, but short term things aren’t so clear. Here’s the S&P daily. Some nice playable swings over the last couple months. If you trade based on the odds and risk/reward, you’d lighten up on longs here and force the market to prove itself. That’s what I’m doing. Overall I like the long side, but in the near term I’m not so sure. It’s time to be more conservative. The market has to play it’s cards first. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 4)”

Leave a Reply

You must be logged in to post a comment.

If the stock market really has some punch to it you should

see the Russell 2000 move at least 2x higher than the rest

of it’s siblings. HW Mon A.M.

Is that the entire Russell 2000? Can you refine it to a strength indicator?

(#2) RichE: these are just general observations I am making based upon the feel

of the market. It sounds confusing. One minute I’m telling everybody to

trade using the charts and now I’m telling you to get the feel of the market.

It’s a little of both, I suppose. But, what I am feeling right now is that

we are still in the bullish trading cycle period and the Russell 2000 is leading

the way down today. HW

IMO that’s the first step in learning how to read charts, prove your gut right or wrong.