Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed – Japan gained 1.5%. Europe is up across the board – gains are muted. Futures here in the States point toward a moderate gap up for the cash market.

Over the weekend I said the easy traders were over. I’ll continue that theme by saying things are less clear now than at any time during the last month. The trend off the Aug low remains up, but there are lots of non-confirmations. Some non-confirmations, such as the lagging banks, can be dealt with . If there are other groups acting very well, the market can continue up in the near term without the banks. Other non-confirmations, such as the lack of 52-week highs, cannot be ignored for long. It’s almost mathematically impossible for the market to move up and up and up and this number not expand.

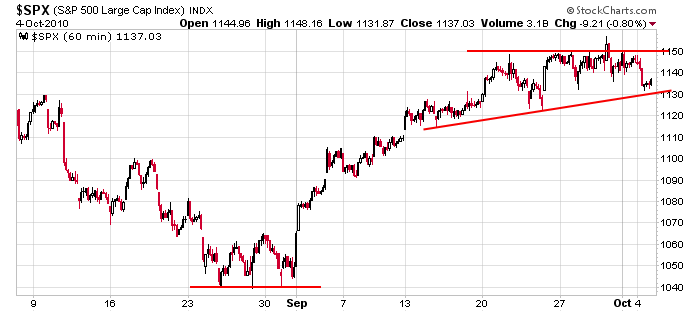

Today’s open will be near the Sep 20 close, so after the S&P moved 100 points in less than 3 weeks, it moved sideways for 2+ weeks. Nothing wrong with this. On an intermediate term basis, my bias remains up. On a short term basis, things are less clear, so I’m being conservative.

Here’s the SPX 60-min chart. There should be pretty good support down to 1120…and resistance at 1150 remains strong.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers