Good morning. Happy Wednesday.

The world is green. Every index in Asian/Pacific closed up including several 1% winners. Every index in Europe is up – several 1% winners there too. Futures here in the States point towards a flat open for the cash market.

Two weeks of consolidation led half the market participants to believe a top was in place and a significant pullback in the works. The other half (me included) expected the intermediate term up trend to remain in place but perhaps a little weakness in the near term. The market surprised both groups by gapping up and rallying hard yesterday on strong volume. The market corrected with time, not price.

I reiterate my belief the market will test its April highs this winter, and after yesterday’s strong day, it may be sooner rather than later. The S&P high was ~ 1220. That’s only 60 points above the current price. But let’s not get too giddy about the possibilities.

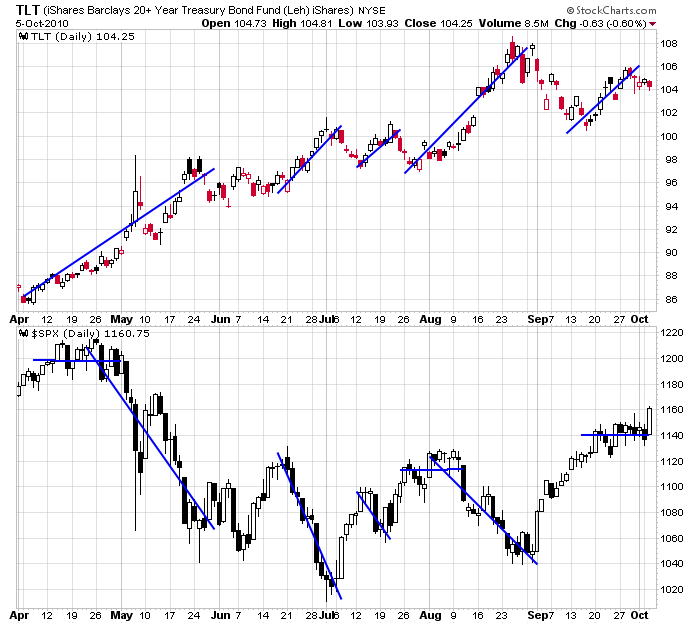

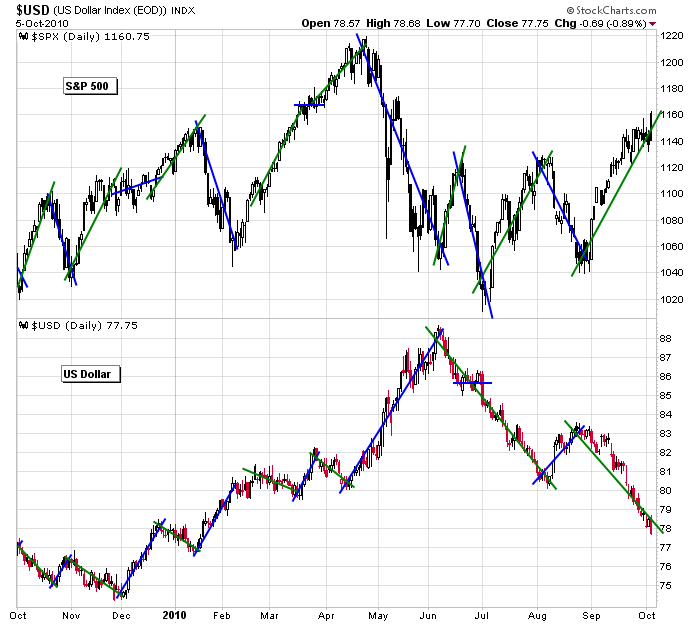

In my opinion there are two key drivers to the market movement right now: bonds and the US dollar.

When money comes out of bonds, the market rallies. Here’s a chart which relates the two.

And when the dollar drops, the market rallies. Here’s a chart.

I’ll be watching both bonds and the dollar to confirm yesterday’s breakout.

I posted a handful of long set ups on the Message Board last night. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 6)”

Leave a Reply

You must be logged in to post a comment.

We should be coming out of the bullish cycle turn dates soon. For those of

you who are new to this, the bullish dates are the last two trading days

of the old month and the first four or five trading days of the new month.

*Yesterday’s rally might have tapped out all of the premium for this

cycle and therefore it might already be over. HW