Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly up – China and Hong Kong led the way. Europe is currently up across the board – gains are small. Futures here in the States point towards a positive open for the cash market.

I don’t have anything to say that I didn’t say in the report I posted over the weekend. The trend is up, and I continue to believe the April highs will be tested this winter. There will be hiccups along the way, but barring totally unexpected events, all signs point towards a continuation of the trend.

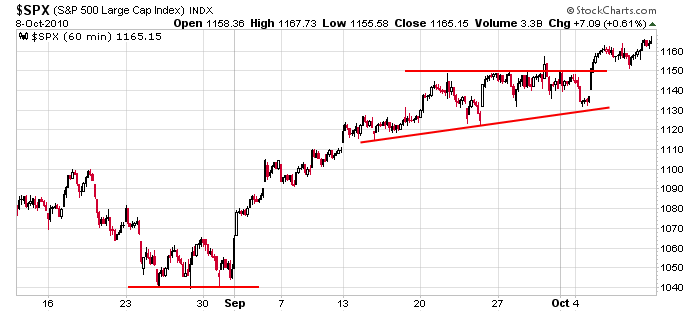

Here’s the SPX 60-min chart. A solid rally off the August low was followed by a couple weeks of consolidation which has now resolved up. From a technical standpoint, there’s nothing wrong with this chart. I’m sure you could search for an indicator to suggest an overbought condition, and that’s fine. It may be a reason to lighten up on longs, but it’s not a reason to guess a top.

Aside from possibly being overbought, one could argue the lagging Nas is a warning and it is. But that too isn’t a reason to abandon all good trades and go short.

That’s it for now. I’m sure I’ll have more to say after the open. Remember earnings season is here…I do not under any circumstance hold into a report.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 11)”

Leave a Reply

You must be logged in to post a comment.

Why you bashing Day Traders, aren’t we in the same boat? Aren’t we all trying to make a buck?

Those are my actual results. The coin toss was an attempt to normalize the odds. It worked for a while, gave me focus, and increased discipline. As to edge, I’d say discipline is your best edge regardless of style.