Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

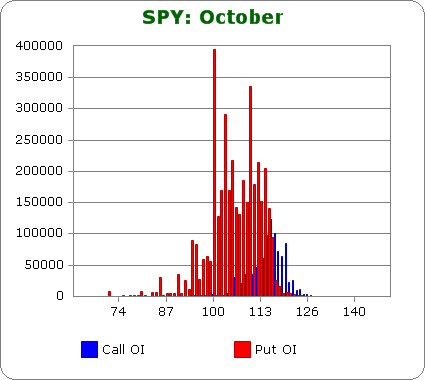

SPY (closed 116.65)

Puts out-number calls more than 2.6-to-1. This is the same as last month. Bearish sentiment remains high.

Call OI is highest between 115 & 120.

Put OI is highest between 100 & 116.

There’s overlap around 115 and 116, but since puts dominate calls, let’s focus on those. With SPY closing at 116.65 today, the stock is already priced to expire most put contracts worthless on Friday. Flat trading or a slight move in either direction would not change the situation.

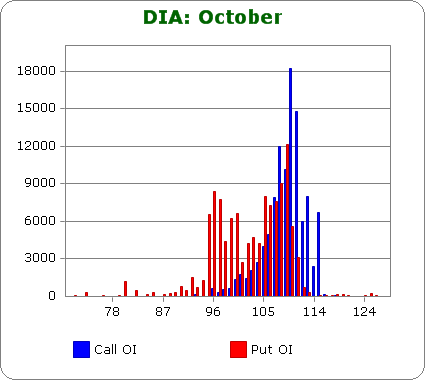

DIA (closed 110.26)

Puts outnumber calls about 1.2 to 1 – less bearish than last month.

Call OI is highest between 108 & 111.

Put OI is highest between 105 & 109.

Calls and puts are nearly equal, and there’s some overlap around 108 & 109. A close at ~ 109 or 110 would expire most contracts worthless on Friday, and with today’s close at 110.26, flat to slightly down trading would do the trick.

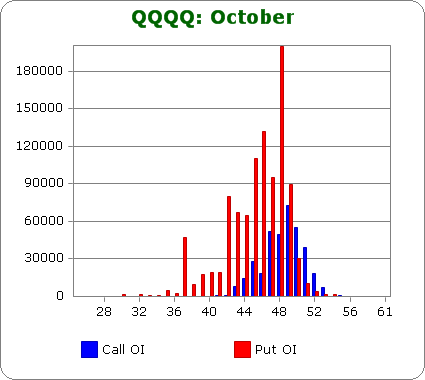

QQQQ (closed 49.77)

Puts out-number calls by 2.2-to-1 – more bearish than last month.

Call OI is highest between 47 & 51.

Put OI is highest between 42 & 49 with the biggest spikes at 45, 46 and 48.

There’s overlap between 47 & 49, but since puts dominate, expiring most of those worthless would cause more pain than trying to expire both calls and puts worthless. With QQQQ closing at 49.77 today, the market is already positioned to accomplish the mission. Flat trading or slightly down movement is called for.

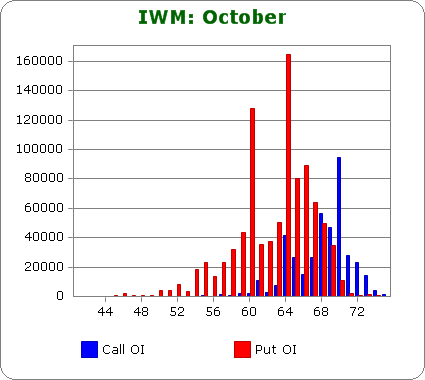

IWM (closed 69.36)

Puts out-number calls by 2.5-to-1 – more bearish than last month.

Call OI is not steady. There’s a spike at 64 and a block between 68 & 70.

Put OI has a spike at 60 and a block between 64 & 67.

IWM closed at 69.36 today, so let’s ignore that put outlier spike at 60. Also, puts dominate calls, so let’s not concern ourselves with the small call spike at 64. What’s left is two blocks that meet at 67/68. If the market closed unchanged relative to today’s close, most options would expire worthless. Slight down trading would be fine…as long as the stock didn’t drop much below 67.

Overall Conclusion: Once again the bears bet big on a big drop, and once again they’ll most likely be wrong. Flat trading or slightly down movement is called for to expire most options worthless and cause the most pain.

Have a great night.

Jason Leavitt

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

I have close on QQQQ as 49.80 today not 45.80?

Regards,

Chet

Chet…you’re right. Bad typo, and it does change the analysis. No wonder the numbers seemed odd. I should have taken that as a hint. I’ll fix it today. Thanks.

JASON

DO U DO AN ANALYSIS OF THE $CPCI–INDEX CHART,WHERE THE BIG BOYS PUT THEIR MONEY

AND THE $CPCE EQUITY OPTS WHERE THE SO CALLED RETAILERS DO THEIR OPTS

MY READING OF THE BOTH CHARTS SUGEST THAT THE RETAILERS ARE GETTING MORE BULLISH,BUT THE BIGBOYS ARE NUETRAL TO SLIGHTLY BEARISH BUT NOT TO LEVELS THAT WOULD SUGEST A MOVE DOWN YET

I WOULD LIKE A CRASH PLEASE BUT REALISE I HAVE TO BE REALISTIC AND TRADE THE CHART

AS A DAYTRADER ITS EASY FOR ME TO HAVE NO BIAS—BUT LONGER TERM IS HARDER

THANK U

Hi John,

Yes I have looked at the difference between those two charts in the past. Perhaps it’s time to revisit them. Thanks for the suggestion.

Jason

Option expiration and earnings reports are holding up the real move, in my opinion. The gov is propping the market for the elections.

We are into earnings and I think we will see positive signs but the real issue is whether or not the better profits came from expansion or just cutting back overhead.

Those who just read the headlines will not know the fundamental reasons for the profits and they can drive the market with false impressions.

Eventually, businesses will run out of ways to cut overhead and the real fundamentals will show up, but not before the elections.

Yes, the market is improving, but inflation and new requirements will raise costs in the next quarter.

I am going to be short the first quarter of 2011

S. Toth