Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed with a bullish slant. There were a few 1% gainers. Europe is currently mostly up. Gains are small. Futures here in the States point towards a positive open for the cash market. However this will likely change because there’s a some economic data out an hour before the open.

As I stated yesterday after the close, the market is getting a little giddy, too giddy for me. It’s been too easy to make money, and when that happens, when you start thinking you’re a genius, the market has a knack for taking back some of those profits. I’m shifting into preservation/management mode and am not looking to initiate new positions right now.

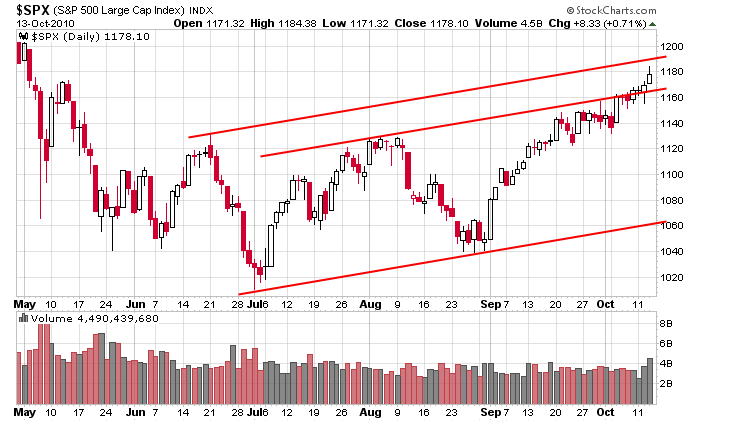

My targets for this move up have been the two trendlines drawn below. The first line did temporarily slow prices down. My second target is about 12 points away. But I don’t hold out for the targets. I don’t assume they’ll be hit. Nobody knows what the market will do. I take profits when it’s appropriate and then I look to re-enter. If I leave a couple bucks on the table, so be it. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 14)”

Leave a Reply

You must be logged in to post a comment.

Jason: About the top red horizontal line in today’s chart. The left touch point was drawn

at about the June 21 high which was a spike, if you look at the chart closely. Therefore,

the red horizontal line just underneath that should be more representative of where

the real picutre is at. No harm intended, I hope. Just trying to help you and the

gang sort out things for today. HW

You talk as if drawing lines is an exact science…as if there’s only one definite answer.

You are entitled to your opinion, but I don’t need any help sorting things out. 🙂

Re: CROX, write a CALL.

opts ex distribution going to script,with a fade into fri

what will the bigboys do to make money next week

perhaps the fed and the pomo need some help

save us some t shirts,hope they have cig pockets–i have worn out all my la and florida t shirts—i love usa t shirts–all my aussi t shirts shrink

aussi js

eat a apple a day befor they get worms from to much googleing

Actually I thing Google and Apple should merge. That’d be one kick-ass tech company.

That would pretty much suck for consumers.

How you figure?

Apple and Google will dominate the mobile device market. Combined they’d practically have a monopoly. RIMM will be the next Nokia. Lack of competition would be back. Let ’em compete…force ’em to constantly one-up each other.

Two things are important when analyzing the market….the technicals and psychology.

Giddiness falls under the psychology category. It’s the opposite of traders getting too bearish. You can sense the cockiness and complacency. Even though the trend is up, it tells me to take my foot off the accelerator.

“too easy to make money”?? -lol- Thats how it feels when one is on the right side of the market. Ask the bears how easy its been for them to make money.