Good morning. Happy Wednesday.

The world is green. The Asian/Pacific markets closed up across the board – there were several 1% winners including India which gained 2.4%. Every index in Europe is up at least 1%. Futures here in the States point towards a relatively large gap up open for the cash market.

The FOMC minutes were well received yesterday. INTC earnings after yesterday’s close and JPM earnings this morning are bringing buyers to the market.

I feel like a broken record. The trend is up, and although the trend is mature enough to justify taking partial profits and using smaller position sizes on new trades, I see no reason to be completely out of the market, and I definitely don’t see a reason to guess a top. Whether the move off the Aug low makes sense or not doesn’t matter. It’s happening, and fighting it is not wise.

Having said this, a gap in your favor is a reason to take a few bucks off the table.

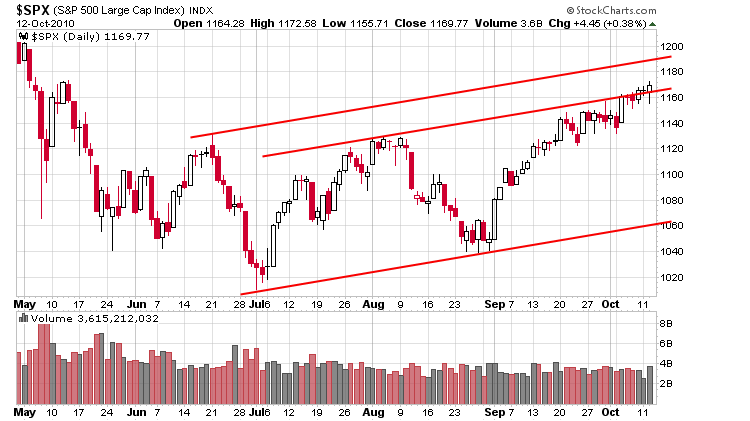

Here’s the SPX daily. Most technicians are eying the May high in the mid 1170’s. I think upper trendline which currently comes in near 1190 is more significant.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 13)”

Leave a Reply

You must be logged in to post a comment.

like Barry says , it’s a melt up, much like April was a melt up. Bad news just keep pushing the mkt higher :-).

China, Yuan and Gold; long video. It doesn’t sound like China will be reducing their reserves. http://www.worldlinkfutures.com/yuangold.htm

the usual opts tape–few days before opts ex is usually the top and a melt down into opts ex

will we get a late day crash–hope so –i am out of longs waiting for my intraday signals to give me chance to go intraday short

is this a market top—well the big boys know–and we will know if they start selling

hopefully catching the fed and the pomo—permanent open market opperations–long–hee hee