Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down – losses were moderate. Europe is currently mostly up – gains are small. Futures here in the States point towards a gap down open for the cash market.

I don’t have much to add to the comments I made over the weekend. The trend is up, but the market feels tired here. Besides being earnings season (increased unknown risk) , the losses from the banks last week definitely get my attention. Are the losses temporary and short term or are they the tip of the iceberg?

I mentioned over the weekend it is my belief the most important “indicator” right now is the US dollar. If it bounces the market will pull back. On Friday it showed signs it wanted to bounce, and this morning it’s up 0.5%.

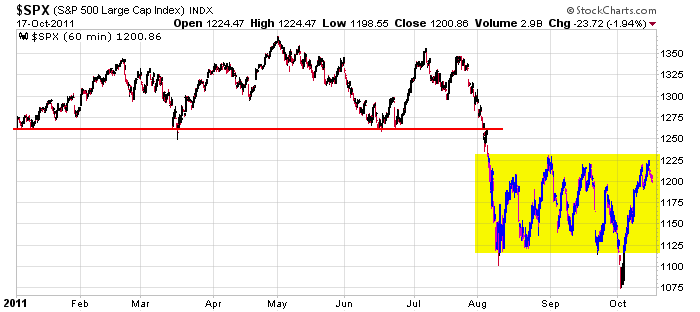

Here’s the SPX 10-min chart. If the market pulls back, my first two downside targets are 1163-1165 and 1150.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 18)”

Leave a Reply

You must be logged in to post a comment.

Pivot Piont formula? What is it?

IVolatility.com says higher

“For example, last year at this time the S&P 500 Volatility Index (VIX) was 21.43 and now at 19.03, both times at levels suggesting equities are likely to be trending higher.”

Put two day traders in a room and you get two opinions. Put two investors in a room and you get four opinions.

QE2 looks like a done deal. I think I’ll go LONG Congressional copy paper.

piviot points–put a big boys in the room and u only get one result—put a computer in the room and u get the same result,because they both use the same piviot points —and they are the nyse piviot points publish to the same formular—i follow the piviot points the big boys use–the retailers can follow me after i follow the big boys—they have their orders in at those piviot points—–i have 6 charts open dji-ym–spx-es–ndx nq all with their piviots on esignal also ftse-dax—i trade all as i have a mind set problem–i dont like seeing a big amt on one trade