Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed with a bullish slant. Europe is currently mixed. Futures here in the States point towards a moderate gap down open for the cash market.

Yesterday the market closed as strong as it’s been in several weeks. Then AAPL and IBM had earnings after the close. Whether they hit their numbers or not doesn’t matter, both stocks will get down several % at today’s open. GS had earnings this morning. It too is set to gap down.

Many stocks are priced to perfection because they’ve been on such incredible runs lately. Buy the rumor, sell the news is a real concept. If everyone buys in anticipation of good news, there’s no one left to buy when the good news hits.

Every index closed at a new closing high yesterday. A pullback, a rest, some consolidation – whatever you want to call it – is normal and healthy.

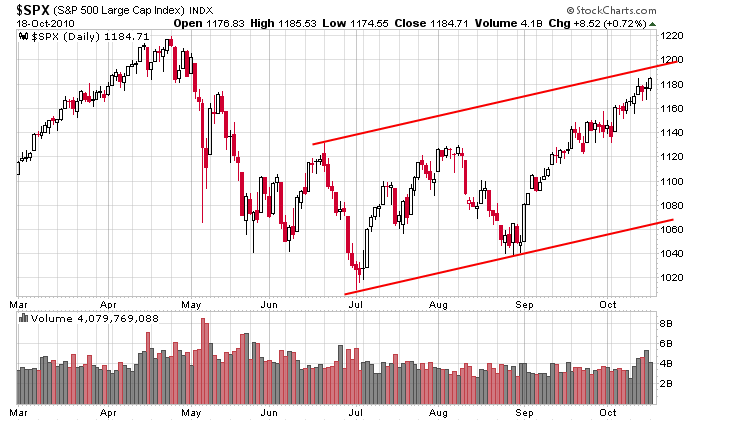

Here’s the SPX daily. The market can pull back several days or longer and maintain its uptrend. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 19)”

Leave a Reply

You must be logged in to post a comment.

Dah perma bull from Brooklyn or whazz it dah Bronx?

And oh by the way Neal, do you prefer Chicago deep dish

pizza or New York thin crust? Inquiring minds want to know. HW

QE2 is a good example of, “Buy the rumor, sell the news”. The actual news release of QE2 hasn’t come out, but the rumors have. The market has increased 10% since the QE2 rumors started, QE2 is already priced in. When the official announcement comes out it had better beat 10% or the market will drop on the good news. Buy the rumor and sell the news just in case the news doesn’t exceed the expectations of the rumors.

(#2) RichE: Quantitative Easing (a/k/a/ ‘QE’) has an unknown quality to it which cannot be easily quantified or even looped into the stock market syndrome. In other words, if it weren’t for QE the Dow might have been down as much as 200 points this morning. 2) Notice

how GS was up right out of the gate this morning. HW

That’s why they’re called rumors Howard, hard to quantify. Not sure your point on GS.