Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down – losses weren’t too steep. Europe is currently mixed with a bullish slant. Futures here in the States point towards a gap up open for the cash market.

On Monday the market closed as strong as it’s been in a couple weeks, so yesterday’s give back was not a surprise. Call it the Euphoric Indicator. As soon as you think you’re a genius, as soon as start getting full of yourself, as soon as it seems too easy to make money because everything you buy goes in your favor, it’s time to get smacked around, and that’s what happened to the bulls yesterday.

Heading into yesterday, the percentage of S&P 1500 stocks above their 20-day MAs had been above 80% for 10 straight days. Now it’s at 69%.

The percentage of S&P 1500 stocks above their 40-day MAs had been above 90% for 7 straight days. Now it’s at 86%.

Indicators which have been overbought and have stayed overbought are now coming down.

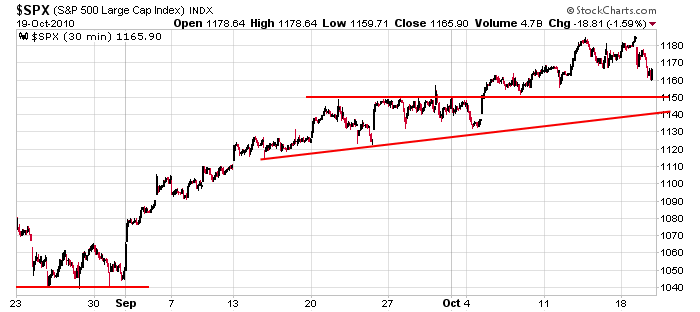

Here’s the 30-min S&P chart. The move off the Aug low has been super strong and steady – 140 points in 7 weeks. Marked are levels I’d consider to be support with 1150 being the big one.

After yesterday, the big question is: how many bulls got burned yesterday and how many of them very badly want to get out if given a chance at a slightly higher level (i.e. how many bad holders wanna get out even)?

The flip side is there are probably many day traders itching to short an early bounce today.

The dynamic is fun. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 20)”

Leave a Reply

You must be logged in to post a comment.

i wannta buy a t shirt with cig pockets after i get a chance to short the market,with my spred bet cfd’s

All I need to do first is learn how to operate SpellCheck !……But seriously Neal, how does one acquire one of your elusive T-Shirts, so that I can be the envy of Bondi Beach ?…

just went short for a small scalp –out now

Anybody can sail a boat on a calm sea.

(#1) Aussie JS : try not to scalp in the pre-market. the volume is way too light.

you may be a hero once in a while, but more often than not it’s a losing bet.

Wait 5 or 10 minutes after the open for the trade imbalance to settle down

and then you have my pre-approval to go for it, dude! HW

Hi Howard–the futures have been open for many hours–in fact they only close for 2 hours a day or ur nite–my cfds are based on futures,plus/minus fair value—i trade the ym,es,nq,ftse/dax/xjo/n225

but true i have more inds available during ur cash market open,but i dont trade vol directly,even though one of my inds includes it

Jay –whilst i cant spell or want to learn—a t shirt with bondi beach on it would be great

most of my worn out ones are la or florida

go the bulls –i need to reload–we have just had a up tick extream–could get a few more–then they can go for gap fill

looks like the markets may be decoupleing from usd and euro–has to happen sooner or later–then maybe a down usd /down markets

nope looks like we are still following the usd—may take u up on ur offer,Neal

Thankyou for your Kind offer there Neal….Now re Hemlock.,Should we drink The poison kind that Socrates drank in 399 BC (could the Dow hit there?} or is that now a preserve of Chicagoians ? OR the suave yet tangy White Rum , OJ etc., ?

Het Aussie JS…Well PUT and where u at in The Land Of OZ ?

See….Told U I need Spellcheck…( Hey )