Good morning. Happy Friday.

The Asian/Pacific markets closed mixed with perhaps a slight bullish bias. Europe is currently mixed and without any big movers. Futures here in the States point towards a positive open for the cash market.

It’s been a heck of a week. The bulls and bears have each had moments to get excited about, but neither group has been able to take complete control. As of now the indexes are up for the week, but gains are small. I got conservative at the end of last week and especially over this past weekend. I didn’t post many new set ups because there just wasn’t much worth playing. Several days of up and down movement hasn’t changed this. After looking at hundreds of charts yesterday, I still conclude there aren’t many high probability swing set ups. I’m laying low. I personally have no problem sitting and waiting for better set ups.

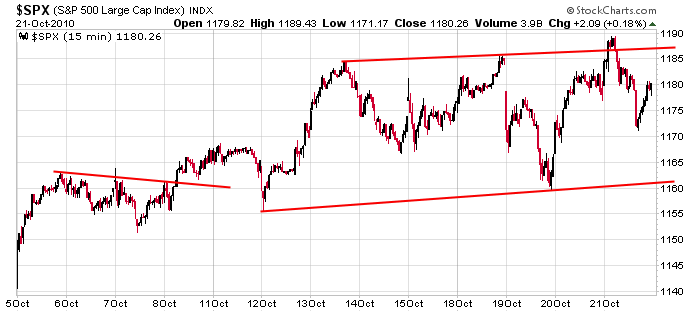

Here’s an S&P chart that is somewhat interesting…the 15-min version. Except for a brief move up and then back down yesterday, the trendlines shown have contained the price action for two weeks. Day traders can trade off these levels until it proves to not be wise. Swing traders, as mentioned above, would best be served right now sitting and waiting for the charts to reset. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 22)”

Leave a Reply

You must be logged in to post a comment.

11am eastern. the market is flat. it is re-booting for the next move. eom HW

Hi Neal! remember once upon a time we talked about those Bollinger Bands?

Please take a look at them now and tell me what you think. They now are

constricting, and will break out to the upside or downside soon.

It’s kinda like a rubber band that is all wound up and will

release it’s force on you. My postman in Brooklyn, NY used to

play around with me using those rubber bands. Come to think of it,

who has the contract with the United States government to supply

the post office with all those little goodies? I wish it was me.

Regards,

Howard Weinstein

NYC