Good morning. Happy Monday. Hope you had a nice weekend.

Except for Japan, the Asian/Pacific markets closed up – there were several 1% winners. Europe is currently mostly up – gains are much more muted. Futures here in the States point towards a gap up open for the cash market that will take out last week’s highs for several indexes.

Over the weekend finance ministers from the G20 promised to avoid a currency war…more specifically they agreed not to constantly devalued their own currency for the purpose of helping their own exports. No guidelines were agreed on, they just agreed to avoid a currency war. The dollar is down 0.75% as I type.

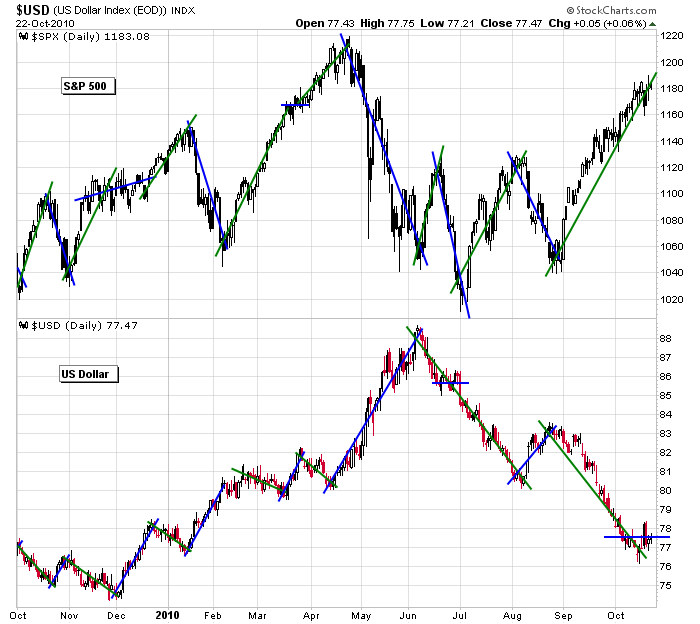

My only reason for talking about news which I rarely mention is because the dollar and the stock market have been so closely linked lately. When the dollar goes down, the market goes up. Simple as that. Throw out all other indicators and factors, this one item is so dominant right now, no other analysis is needed.

Here’s the SPX vs the dollar. It’s a little confusing because it covers 12 months, but if you look closely and match the two up month by month, you’ll see they’ve been moving opposite each other for the last year. Last week they diverged (both moved up). We’ll see if this was 1) temporary or 2) the first step in their divorce.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 25)”

Leave a Reply

You must be logged in to post a comment.

The thought occured to me that all of these finance ministers

got together at the G-20 meeting and then they all agree to

this, that, and the next thing. Who is to say that when they

get back home they are going to do whatever the hell they want?

Pardon me for being suspicious, but that’s what happens to you

when you get a little bit older. HW

usa stocks are geting cheaper and cheaper from a overseas perspective—but who wants to hold a falling asset–from a overseas veiw

it takes a lot to move a currency but the POMO -permanent open market opps is having a good go

plus china/singapour is dumping usd’s in favour of euros

a 5 min usd chart is a must next to my futures and other live charts

yes, i did notice that little blip in usd /stocks last week,Jason

Jason, there’s a difference between news and noise. Thanks for providing the news.

Howard, I agree, what’s to keep them honest? Who would benefit, who wouldn’t? What determines a currency’s value? Granted, a country can manipulate, but at the end of the day what determines the value? Is it solely supply and demand? But, demand for what?

Thanks for another perspective Aussie Js. It’s always good to see the other side.

And yes! I’m Forex and bond challenged. Who the heck would want to buy money and signature notes? Give me a building.