Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up – there were several 1% winners. Europe is currently mostly down – losses are small. With about 20 minutes to go until the employment numbers are released, futures here in the States are down a couple points.

Here are the employment numbers:

unemployment rate: 9.6% (third straight month)

nonfarm payrolls: up 151K

private payrolls: up 159K

average workweek: up 6 minutes to 34.3 hours

hourly earnings: up 0.2%

After the numbers were released, futures jumped, and assuming they hold, we’ll have an open above yesterday’s close.

The market busted out in a big way yesterday. There was no attempt to fill the opening gap up. When looking at the last couple months, the market could not be stronger. But when you back the charts up, all the market has done the last two months is retrace its losses from April, May and June, and I could still argue the market is still range bound going back to Sept 2009.

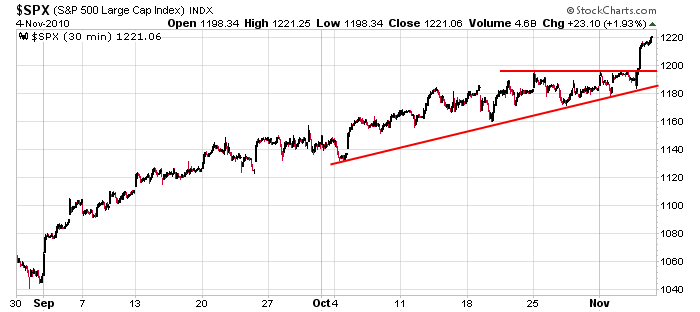

Here’s the SPX 30 min chart I’ve been posting the last week. Looks pretty bullish to me. 🙂

Are we gonna have another “gap and go” day? I could not argue with you if you wanted to take a few bucks off the table, but I have no idea why the bears continue trying to pick tops. The big money is made riding the big trends, and since we don’t always have a big trend to ride, when we do get one, it’d be wise to ride if for everything it’s worth. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 5)”

Leave a Reply

You must be logged in to post a comment.

To My Dear Friend Neal: I want to say good-bye to you for now.

Oh, no…I’m not going anywhere. It’s just that you said that

when the Dow hits 12000 you are going to stop posting comments.

Well, the market has been on such a tear lately (up +16% since

September 1st), I would expect the Dow to turn 12000 any day now.

You are always welcome to visit me here in New York City and

I’ll show you things that the tourists don’t normally see:

(i.e., a drug deal going down in east harlem, a homeless person

taking a leak underneath the Brooklyn Bridge, etc.) HW!

YES US BEARS NEED SOME MONEY TOO –NEAL

to keep us interested even if its a counter trend trade

but as a daytrader counter trend trades are only a few minutes

mostly within a day there are numerous up /down trends–so can go long and short many times

price just ebbs and flows between support /res and pit trader piviots

NEAL–I AM THE MOST OBNOXIOUS,VICIOUS,FEROTIOUS,GRUESOM BEAR dressed in a bull suit

i spent many lifetimes as a pirate and a inter galactic renegrade

i am just so glad everyone is so bullish lately–it means my spoils will be great,when i take off my bull suit

if u turn usa upside down it fits into oz just perfectly,with the florida pan handle being where i come from–i live on the barrier reef in a place called townsville near cairns

from my beach side patio overlooks magnetic island—–crocodile land

does anyone read these after market closes

“I could not argue with you if you wanted to take a few bucks off the table’

I must agree. I think the market is getting ripe for some profit taking but I do not see that happening until the VIX spikes.