Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed and with a bullish slant. Europe is currently mixed and without any standout winners or losers. Futures here in the States point towards a small gap down open for the cash market.

This of course comes off a week many market participants thought there’d be some selling pressure after the elections (buy the rumor, sell the news) which didn’t happen because, well, there was too many people that thought it would. Now the bulls are giddy and relieved and the bears are totally frustrated and those who cashed out are scared they’re going to miss the next leg up. It would make perfect sense for the market to give some back this week – exactly what many thought would happen last week but a week delayed.

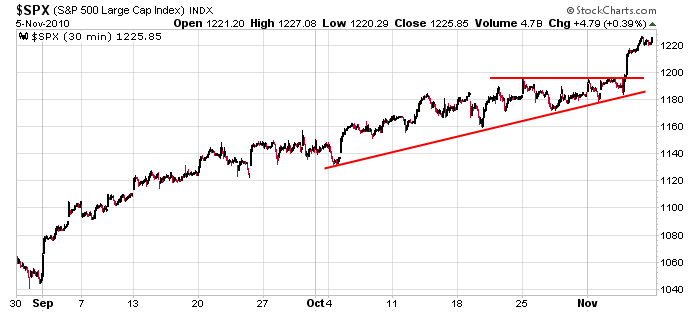

Here’s the 30-min SPX chart I’ve been posting. The relatively gentle move up popped last week. There’s nothing technically wrong with this chart…even a 30-point pullback would not destroy the trend.

The trend is up…don’t fight it…but be on the lookout for a correction. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 8)”

Leave a Reply

You must be logged in to post a comment.

a bull correction,with NO ONE calling for a return of the bear

what do the internals say

perhaps the bear is dead

perhaps the bear and bull are desperately frustrated

what does the usd say

will the correction start in europe

does the euro control the markets

i trade negative and positive energy and i love making my broker rich as that means im geting richer

a exterior mind set is required for all trading

Great summary of the overall trend. Thanks!

a external brain is a zoombi

but to play the game from above is a master

trading is 10% know how and 90% mind set

Stop, “giving you the gears”? Ok broker basher. BTW, wouldn’t a solution be more positive than continually bashing? Duh!

Blagh markets grind higher and can grind that way for months.