Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed with some moderate losses in both directions. Europe is currently mostly down. Futures here in the States point towards a flat-to-slightly-down open for the cash market.

So let’s see. Two weeks ago many were predicting the market would sell off after the election…it didn’t happen, the market rallied hard.

Coming into this week the bulls were giddy and the bears were frustrated again…the mood has already changed.

The market is operating to frustrate the most number of people possible. 🙂

Heading into today I think many market participants accept that we may have some weakness in the near term, so if the market really wanted to confuse everyone, it would move up. 🙂 It’s at least something to keep in mind. I’m in cash in my trading accounts. I’ve done very well the last couple months, so I’m content to wait patiently for the next round of moves. Maybe the charts reset this week or maybe it takes two or three weeks. I don’t know, and I’m not exactly on the edge of my seat in anticipation.

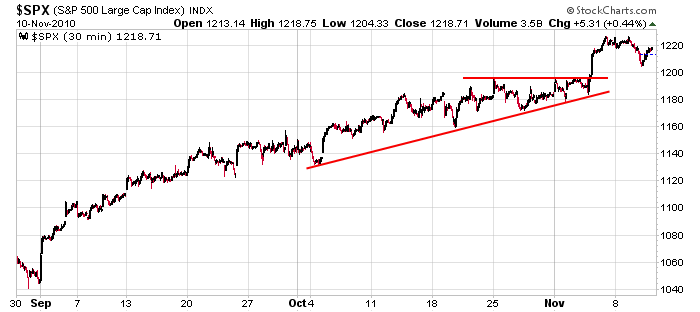

Here’s the 15-min SPX chart. First target on a pullback is 1190-1195.

More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 10)”

Leave a Reply

You must be logged in to post a comment.

Have to hand it to Neal, it got a lot farther than some of the blogs I’ve been following. Hey it may not hit 12000 but it came close.

Cash? Come over to the Dark-Side Luke, short the next lower-high.

On a serious note, Ta Da, (that’s about as serious as I get) where are you placing support for this correction? I’m guessing 1150 SPX.

I think Dow will hit 12000 before I get my T-shirt !

Jason always has a level head without bias

market chern is hard to trade

my nyse tick indicator being mostly in the negative with many tick extreams even as price may be going temporaryily up indicates the big boys are selling into any strenth

the trend is up till the big boys dump

Hi gang! It looks like Neal is prematurely celebrating

his call on Dow 12000 and he just may be right. However, my

sources(the Elliott Wave people)tell me they are going to keep

the market relatively intact through the end of this year.

Then we have the traditional ‘January effect’ and

the heavy selling will commence shortly thereafter. HW