Good morning. Happy Thursday. Happy Veteran’s Day.

The Asian/Pacific markets closed mixed and with a bearish slant. Europe is currently mostly down. Futures here in the States point towards a moderate gap down open for the cash market.

The big news today comes from CSCO which did well with earnings but then issued warnings about the next couple quarters. Warnings of challenging times are not good, but coming from CSCO it’s even worse because their CEO is among the most bullish people out there. He is always super positive. The stock is down over 16% premarket.

The market has been moving opposite the market’s mood lately, so heading into today I was leaning to the downside because yesterday was one of the strongest closes we’ve had in over a month. More than two-thirds of the S&P 1500 closed in the upper 30% of their intraday range, and more than half closed in the upper 10%. Even on a strong day it’s not common for that many stocks to close at an extreme.

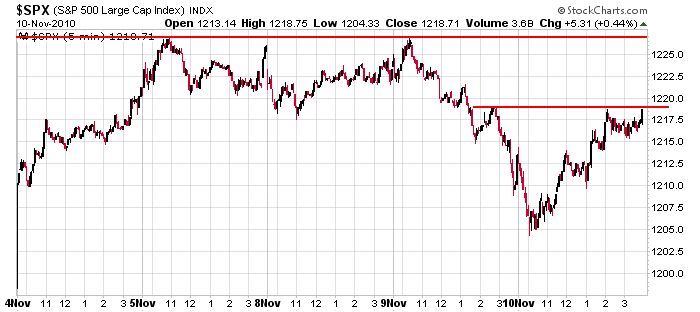

I maintain my stance the on an intermediate term basis the trend is solidly up, and believe it will continue to be up. Short term things are less clear, so I’m patiently waiting for the charts to reset. Here’s the 5-day, 5-min SPX chart. There’s nothing very telling here, and we still have last week’s big gap up partially unfilled. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 11)”

Leave a Reply

You must be logged in to post a comment.

You need a pair to trade CROX.

On this Veterans Day my thoughts go out to the dearly departed

who fought and died for this country. In fact we are and have

been engaged in WW III since 9/11. Although if you had to

quantify it, it would be characterized as a ‘passive’ war

as opposed to the conventional warfare we are more accustomed

to seeing since the beginning of mankind. Cheers, HW

War is hell, lest we forget.

Yes we are listening to your live recordings on stocksthatmove.com

You wanted someone to post and I know a few people that listen!

Thanks Darren.

The 1208 today appears to be an ABC down reaching the 1085 area. I am also concerned that Gold could correct soon – sharp and quick to 1100 or thereabouts. The recent margin increase for silver was meant to slow down that move. I think it is destined for much higher unless Ben B relents. My gurus in the money business think he is on thin ice and that means all of us.

As usual the blog is good. Thanks.

perhaps the precious metals may double top here, dollar has got to rally with yields coming up.