Good morning. Happy Friday.

It’s not such a happy day for markets around the world. The Asian/Pacific markets are down across the board with many sizable losers including China which lost over 5%. Europe is mostly down, but losses aren’t too bad. Futures here in the States point towards a large gap down open for the cash market.

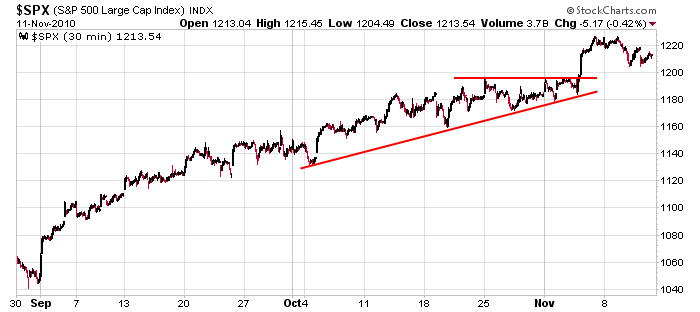

We entered this week with the odds favoring a little give back following the election/FOMC rally, and that’s exactly what we’ve gotten. In the grand scheme of things the pullback is nothing out of the ordinary. The S&P moved 180 points in just over 2 months – it deserves a little time off.

Your trading style, the set ups you like to trade, will work great some of the time but not all the time. A swing trader will trade aggressively for a couple weeks or months and then lay low waiting for the charts to reset. That’s what I’ve been doing the last week – laying low waiting for the charts to reset.

Here’s the 30-min SPX. I see nothing wrong with the big picture. Let it come down a little to shake out the weak longs. The charts will reset, and then more likely than not another leg up will begin.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 12)”

Leave a Reply

You must be logged in to post a comment.

With six straight days of POMO to come beginning today 11/12/10, I am very hesitant to be short.

I tend to agree Mark. Day to day anything goes, but 6 straight days is a lot.

Personally I think the SPX is going down to 1150 just to piss everybody off, then the funds will rebalance getting rid of pure US equities and loading up on foreign, foreign present and commodities.

Yes I agreee with Rich.

But then I think we will see one last rally, a Wave 5 in Elliott Wave terms. My guess is that this selloff will last about 3 weeks from the recent high, then rally into the later part of January, top there and then start a major decline. It could even go longer than January but all we can do is wait and see. Both of these trends are tradable.

Bonds and commodities look to be trading tinto a GANN brealdown pattern. I suspect that the S&P could be moving there also. Just a thought.