Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

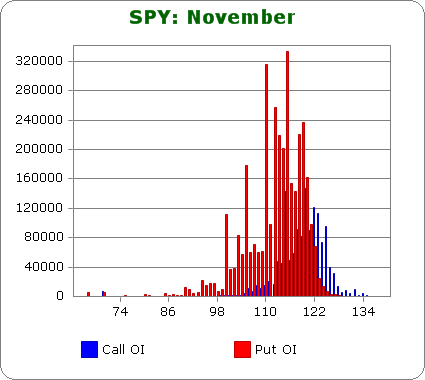

SPY (closed 120.03)

Puts out-number calls more than 2.3-to-1 (last month was 2.6:1). Bearish sentiment remains high.

Call OI is highest between 113 & 125 with spikes at 115 & 120.

Put OI is highest at 122 and below.

At today’s close, those who bought 115 calls probably have a decent profit, but otherwise with pretty much all the put buyers are under water (even those who bought the 122 strike likely bought when SPY was further in the money, so even they are down money), most option buyers are showing a loss. A flat market the rest of the week would cause the most pain, and a small move in either direction would do nearly the same.

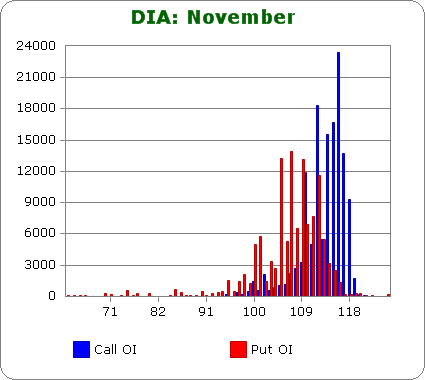

DIA (closed 112.25)

Puts outnumber calls about 1 to 1 – slightly less bearish than last month.

Call OI is highest between 109 & 118.

Put OI is highest between 105 & 112.

There are matching spikes at 110 & 112 with most other call OI falling above 112 and most put OI being below 110. Hence a close somewhere between 110 & 112 would cause the most pain. Today’s close at 112.25 puts us at the upper side of the range, so flat-to-slightly-down trading is needed the rest of the week.

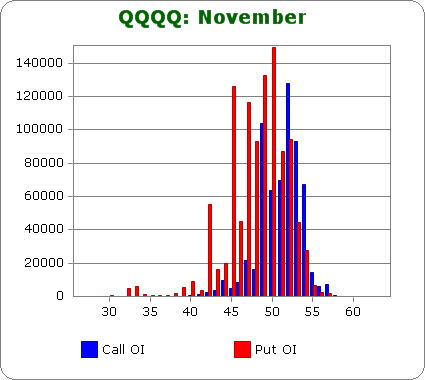

QQQQ (closed 52.29)

Puts out-number calls by 2-to-1 – slight less bearish than last month.

Call OI is highest between 49 & 54.

Put OI is highest between 42 & 52.

There’s solid overlap between 49 & 52, and since put OI easily outnumbers call OI, a close on Friday somewhere in the top half of the overlap is likely to cause the most pain. With today’s close at 52.29, flat-to-slightly-down trading the rest of the week will accomplish the mission.

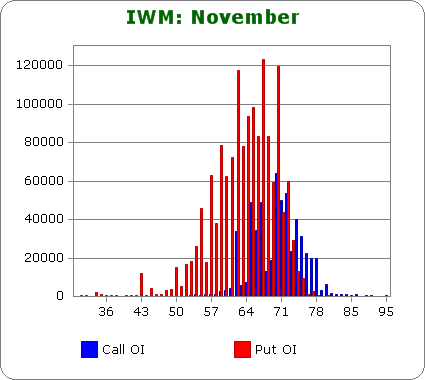

IWM (closed 72.04)

Puts out-number calls by 3.2-to-1 – more bearish than last month.

Call OI is not steady. There’s a spike at 62, a block between 65 & 67, and a block between 70 & 72.

Put OI is huge from 72 and below.

Since put OI far out-numbers call OI, let’s focus on the puts. With today’s close at 72.04 – the top of put OI block – virtually all put buyers are under water. Flat trading or a small move in either direction wouldn’t change the situation.

Overall Conclusion: The bears once again bet big on a downside move, and barring a massive sell off the next couple days, they’ll once again be wrong and lose money. Flat trading the rest of the week would cause the most pain. A small move in either direction would be fine too. As long as we don’t get a massive sell off, lots of pain will be inflicted.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

im a perma bear and i just love taking scalps with counter trend snipper action until –our day will come–some times i cross dress and ride the bulls

but i just love learning what the well educated bulls are doing with their open interest opts manipulation

thanks Jason for posting these—i also follow the $cpci and $cpce charts and market internals

but dont trade opts

as a index daytrader im able to take more bull scalps than a swing or position trader which lately has been in the bull favour,but they have a good flavour

as normal the bigboys roll over from last week and early this week hence the move up early week to sell of into opts ex fri –the retailers always leave it till last minute