Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down – China dropped 4%. Europe is current mostly down – losses are moderate. Futures here in the States point towards a moderate gap down open for the cash market.

The market has dropped 5 of 6 days…all the post FOMC gains are now gone.

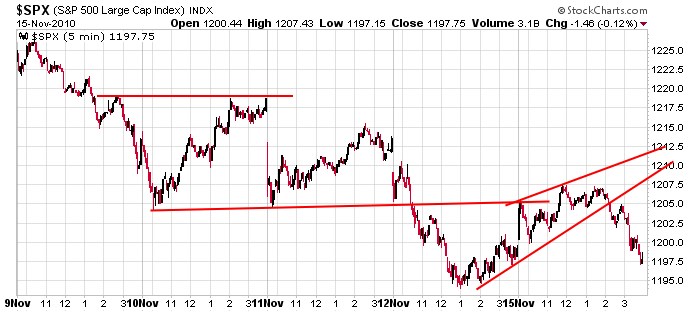

Here’s an update of the charts I posted yesterday. My hypothesis that the short term trend was down and lower prices were more likely than higher prices (even if the market opened on an up note) was correct, but the gap up widened the bearish pattern. The 5-day, 5-min chart is below. Today’s open will be below last Friday’s low, so the pattern of lower highs and lower lows continues.

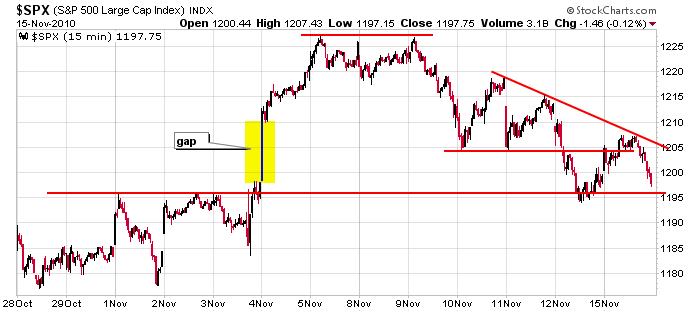

Backing the chart up a little, here’s the 13-day, 15-min chart. The post FOMC gap has been filled…the index is back in the churning range that existed heading into the election.

The talk at the end of last week was that every day this week was a POMO day, and since the market has done much better on POMO days than non POMO days, everyone’s bias was to the upside. Hence it makes perfect sense for the trade to not work any more. Trade what happens. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 16)”

Leave a Reply

You must be logged in to post a comment.

12000 or 2000

AUSSIE JS : You’ve got a good point. It’s not really the one

who decides which way the market goes from here. But…..when

you factor in the the devaluation of the US dollar and apply

that to our day to day life here in America it changes up the

game a whole lot. Bottom line: 1. the Fed is trying to play

God by tinkering around with the money supply and; 2. injecting

liquidity into the system should be used ‘not’ abused. HW

its the banks–they are all bankrupt—ireland says its not bankrupt just its banks that it owns–the lier loan salesmen after they finished with usa went to spain and europe/iceland

its a big PONSI –but dont tell anyone—its a secret and we might be able to squeeze a few more bob out of the market

SO WE NEED TO TRADE WHATS IN FRONT OF US OR AT LEAST ON THE 1 MINUTE CHART

Dumb question: what’s POMO?

POMO stands for Permanent Open Market Operations. Here’s a link to their schedule…

http://www.newyorkfed.org/markets/tot_operation_schedule.html

Hi Neal,–we go all the way with LBJ—imo to much so -we just bankrupted ourselfs with stimulus that sir tim told us to and now have had to put up interest rates to near 5% to cool down things

QE2 is not for the usa economy its to bailout the fed and usa banks—audit the fed

darn choppy open–took profits premarket –waiting for some bulls to short atm

ur rising usd is the us carry trade coming off and back to usa—-risk off

Neal–In answer to your Q re: WW2 Bombings…well they happen to Darwin so only a lil scare, like the Subs @ Bondi Beach which plummeted the Prop Values (you have the SDCL we had the SCUD !ps STILL waiting for my T-Shirt (or are you waiting for a support pkg from Helicopter as well ? : } Jay

even those 4% will be on food stamps soon

wait till the spanish debt is allowed to serface—see spanish banks

then there is the french ,italians–oh what about the german deutcher bank–a big manipulator

uncle ben may bail them out –he runs the imf

its a debt problem—bailouts only add fuel to the fire

BUT TRADING IS NOT ABOUT FUNDAMENTALS—im a funny mentalist

Well the plan was to learn very quickly the Art of chopsticks (or at least how to make Sushi)….. fORTUNATELY WE HEADED THEM OFF @ KOKODA IN PNG : }