Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Europe is currently up across the board – gains are small. Futures here in the States point towards a small gap up open for the cash market, but this is likely to change with all the economic numbers to be released.

Anyone who has entered positions based on historical tendencies has gotten killed the last couple months. The market is typically weak Sept and Oct – this year the months were super strong. Nov is supposed to be strong – other than the first week, the market has been weak. Also the market tends to do well into holidays – not this year. If you’re going to enter a position based on historical tendencies, you have to enter the trade every year for 20 years to get the numbers to eventually go in your favor. Me? I keep historical tendencies in the back of my mind, and then I just trade what’s unfolding in front of me. It sounds goofy, but I’ve found it more profitable to trade what’s happening, not what should happen.

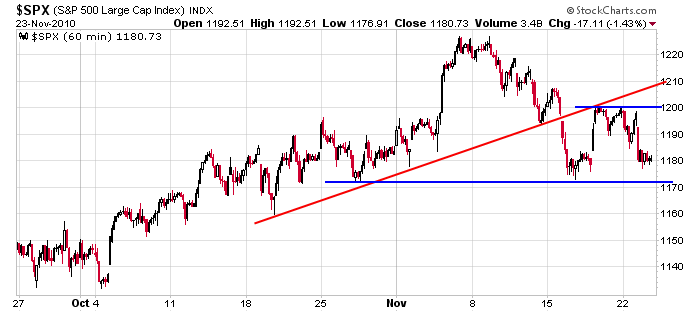

This is how I see the 2-month chart…a great run up in Oct followed by early Nov gains which have been given back. The market is approx. flat for the month which isn’t bad considering the massive rally off the Aug lows.

The charts don’t look too bad…the indicators don’t look too good…and event risk is high. This is not a time to take big chances.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 24)”

Leave a Reply

You must be logged in to post a comment.

What happened to the municipal bond market – why the sell off?

Will it recover?

I’ve seen some crazy things happen on Black Friday. In fact, we might

have already drawn out the profit up against Friday so it may be a flat.

As for me, I’ll be hanging out with the homeless people underneath

the Brooklyn Bridge and going to a NYC church for Thanksgiving Dinner. HW