Good morning. Happy Tuesday.

The Asian/Pacific markets closed down a bunch. There were several 1 and 2% losers. Europe is uniformly down more than 1% across the board. Futures here in the States point towards a large gap down for the cash market. This comes off a day the market was weak early and strong late and closed only a couple points from its 5-day high. But news trumps the charts, and today’s news comes out of Europe and the East where debt worries are mounting and N. Korea supposedly fired several artillery rounds into S. Korean territory.

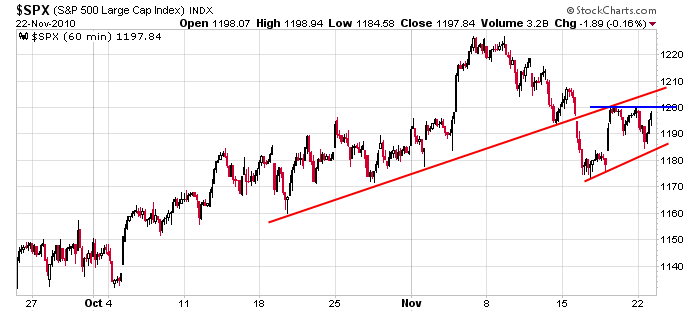

Here’s the 60-min SPX charts I’ve been working off. A bear flag/wedge within a short term downtrend. Resistance has also formed at 1200, and with today’s gap down, the open is likely to be near support.

My stance remains the same. Near term things are not clear so trades are to be kept short term. The charts and indicators are not telling the same story, so it’s not wise to be aggressive in either direction. In the intermediate term, the trend is up, and I’m expecting higher highs once this soft patch plays out. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 23)”

Leave a Reply

You must be logged in to post a comment.

I have to agree with Neal on this one. Let’s say, for example North Korea lobbed

a scud missle over the Pacific Ocean into American waters. That would be another

story. I agree that his analysis is correct, and I look for a relief rally

later on this afternoon. HW

I do not see any good trades developing today! There is a good time to walk. When the pitcher is throwing curve balls in the dirt why swing?

Does anybody remember my post from yesterday?

According to the ‘X and O’ chart it looked like

we were consolidating and headed for a breakout

(most likely to the upside). Well, 1/2 right is

also 1/2 wrong, so we’ll see what happens in

the A.M. It’s already the A.M. in AUSSIE J land. HW