Good morning. Happy Monday. Hope you had a nice weekend.

The market sold off into last Friday’s close but still closed at its highest level of the week. If the current futures levels hold, the late-day losses will be recaptured at today’s open. The Asian/Pacific indexes closed mostly up with a handful gaining more than 1%. Europe is currently up across the board.

Give the extent of the move off the July low and where we are in relation to previous activity, … I don’t think there are obvious support and resistance levels to trade off. We are somewhat in no-man’s land.

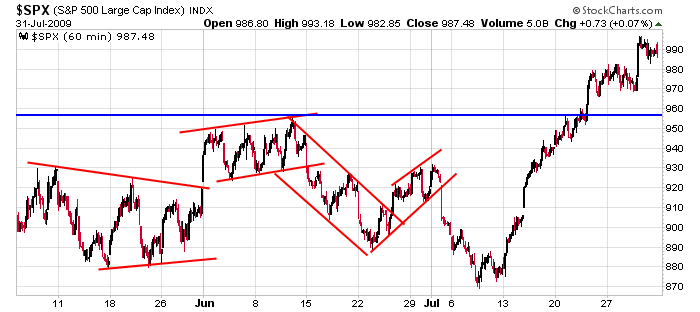

Here’s the SPX 60-min chart. It’s gone 120 points in 3 weeks and is at its highest level since last November. Psychological resistance may exist at 1000 (that also happens to be where the upper Bollinger Band on the weekly chart sits), but without a decent amount of trading taking place there, the level is more mental than technical. And support? Your guess is as good as mine. Sure I could draw a trendline under the lows and call it support, but the line is so steep. Mathematically it has to break eventually, and a break doesn’t necessarily spell an end to the trend. The market may continue up at a slower pace.

As I said over the weekend, the trend is up; don’t fight it, but don’t get complacent either. The market isn’t going to go straight up forever. I’ll post more comments after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases