Good morning. Happy Tuesday.

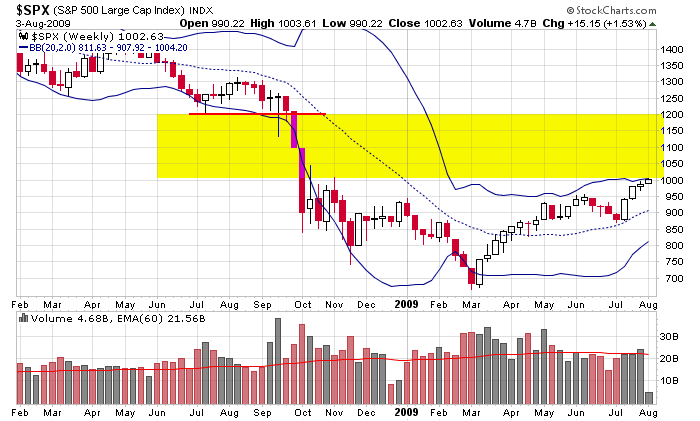

The SPX moved above 1000 yesterday, but there were no fireworks. There was no mad rush to buy, and there was no urge to sell. The index merely moved above and below the level most of the day before closing near its intraday highs. I personally don’t think the level means much other than offering the media something to talk about. From a technical standpoint, it’s not resistance – it’s no more important than any other level on the chart. Here’s the weekly. The upper Bollinger Band sits right here, and thin trading exists above. Thin trading can act as like a gap …– not much volume took place so there won’t be many traders looking to get out even.

The Asian/Pacific markets closed mixed – there were no standouts. Europe is currently down across the board – most indexes are down at least 1%. Futures here in the States are down moderately suggesting a gap down open for the cash market.

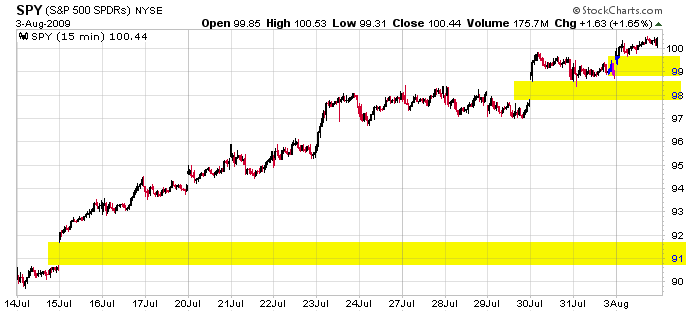

The move off the July low now has 3 unfilled gaps. Here’s a 15-min SPY chart.

My approach remains the same. The trend is up; my bias is to the upside. But the market isn’t going to continue at this pace forever. A 120-point SPX move in 16 days is pushing it. I’ll day trade in either direction – whatever is appropriate. For swing trades, I’m only interested in the long side, but the higher we go, the less favorable the risk/reward gets, so we gotta play good defense. Don’t give back hard earned profits. That’s it for now. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases