Good morning. Happy Monday.

The Asian/Pacific markets closed mixed and with a bullish bias. Europe is down across the board – losses are moderate. Futures here in the States are down slightly.

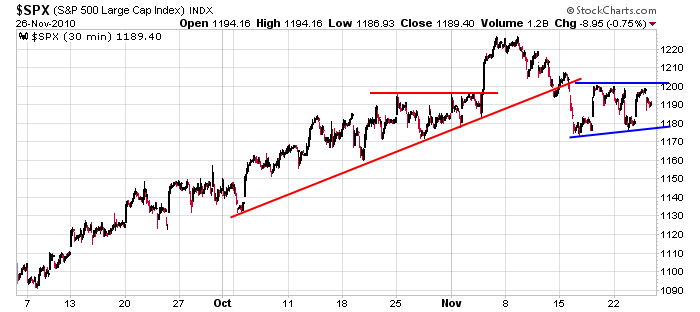

The market has been all over the map the last couple weeks…large gap ups, large gap downs, sudden rallies, sudden sell-offs. In the end the indexes are unchanged over the last 8 trading days. This isn’t bad considering the negative news out, but the “relative strength” isn’t a reason to blindly hold. Here’s the 30-min SPX chart going back to the first week of Sept. It’s steep uptrend was broken two weeks ago, and now it’s been consolidating in a range. This is more bearish than bullish.

Event risk is high. Bad news can easily push the S&P down another 50 points, but bearish sentiment has grown enough that good news or a lack of bad news could squeeze the market higher and back to its highs. In my opinion, this is not a time to be aggressive. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 29)”

Leave a Reply

You must be logged in to post a comment.

a market for daytraders

DAX currently has a large key reversal and ndx should follow

usd has been breaking out and euro is not a hero

some nice volitility

am flat now after some nice moves

im looking for somemore bulls to short

of course its a illusion ,Neal

but when i was a admiral in the galactic confederation with my own squadron of space ships,patroling this sector of the galaxy—we did have compasses

and oz is the right way up and when u turn usa up the right way with florida up top,it fits just nicly into oz–i live in a place called townsville nr carins on the great barrier reef

when usa is turn rifgt side up that would be equilivent to miami

just took somemore bull scalps–dax is off 200 points –ftse doing well on downside too

also got some ndx and dji scalps

narket should go up now for europe close and i can reload again

at 100 bucks a point on dji and equivelent on others only retailers buy shares

i spreed bet the indexes with cfd’s —not sure if usa uses cfd’s

Neal,–probably a little late for u now

cfd= contracts for difference–the spread or only commission is the difference between the bid and ask–its tax free in london as its called gambling as the market maker -book maker makes up the bid /ask==u can bet on anything weather–football even space direction—oh indexes and shares

so u liked my sence of humour-ah

see i got my bulls to short at close—or am i shorting the pomo -fed

oh index cfds are based on futures price plus or minus fair value which is published each day