Good morning. Happy Tuesday.

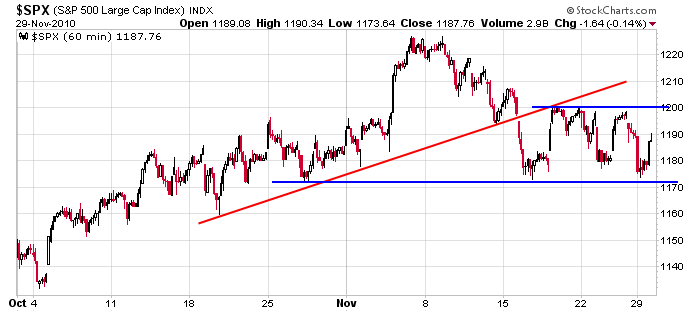

The Asian/Pacific markets closed mostly down – China and Japan lost more than 1%. Europe is currently mostly down – losses aren’t big. Futures here in the States point towards a moderate gap down open for the cash market. This comes off a surprise vertical rally the last 90 minutes yesterday which closed the S&P in the middle of its 2-week range. Here’s the 60-min SPX chart I posted several times last week. The market is unchanged over the last two weeks and unchanged since the end of Oct.

Don’t harbor too strong of a bias here. We’ve had several sudden moves up and down the last two weeks, and in the end the market has gone nowhere. We’re still getting lots of mixed signals…the charts look decent, but the indicators suggest more downside is coming…the time of year and Fed action say up is the path of least resistance, but historical tendencies have been completely ignored lately, and the market has not responded positively to POMO days the last two weeks. There is no clear bias here in the short term. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 30)”

Leave a Reply

You must be logged in to post a comment.

Jason, what is POMO? Please explain.

Ground control to Major Tom. Ground control to Major Tom.

Are there any Weinsteins living in Australia? Please let

me know. HW

The european banks are about to get cliped

i was a pirate many lifetimes ago,

but now im honest oz-ie

its a hard day for a daytrader today–had some trades before the bell but am flat

we hit 1273 spx and bounced–i usually stay out at sup/res and wait for a result

Neal whos address did u want

ooops big typo—-1173

must have 12000 on the brain

im not in the mood to be a bull tonite—might go to sleep—its 1.30 am

normally sleep during our day as our xjo has no volitility–it only trade 30 -50 point range per day—75 points is big for us

Neal –i never emailed u ,but a dow 6000 or bondi t shirt would be good

xxl with cig pockets

ditto. Dow 6000. I’ve been saying that all along. HW