Good morning. Happy Thursday.

The Asian/Pacific markets closed up across the board. Europe is currently posting pretty good gains. Futures here in the States point towards a decent gap up for the cash market.

This of course comes off a massive move up which put the small and mid caps at a new high and the other indexes above their recent ranges.

Coming into this week the short term trend was unclear and the longer term trend was up. It now appears the longer term trend has reasserted itself. But I’d be a little surprised if the market had another runaway day because of tomorrow’s jobs report. Once that’s out of the way, a steady move up into the end of the year can begin.

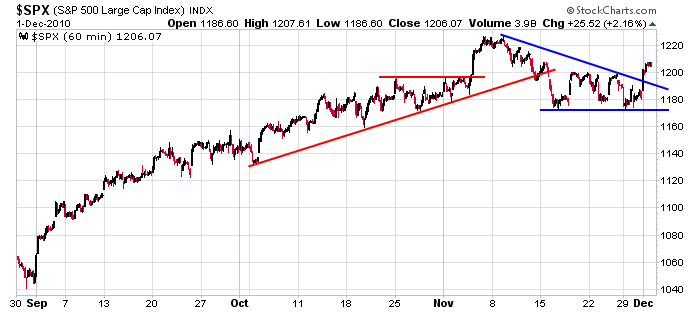

Here’s the 60-min SPX chart since the end of August. This is why I’ve kept saying: “the charts still look pretty good.” It’s because they did. I have viewed the last couple weeks as a pullback/consolidation within an uptrend. Now the uptrend can resume.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 2)”

Leave a Reply

You must be logged in to post a comment.

the usa is of the coast of oz

not sure the markets wont go the way of the usd

not even the fed or pomo can defeate it

(#1) Aussie J: please explain: what is pomo?

(#1) Neal: I think that anybody that follows this particular

blog knows all about limit orders, market orders, etc.

some–but its a country town compared to sydney —its mining territory,but perth is a very nice place and a good place to live

pomo—-PERMANENT OPEN MARKET OPERATIONS—-was called the plunge protection team ,but now that usa govt had a falling out with goldmans–the fed has probably pinched all their best traders and is many days the only one in the market—i think they are bulls

they may even be in the market today

bigest prob for the ndx is the dax which is forming a broadening top

and for the dji -the ftse is giving a little wave 2 up or a abc corection up

europe opens usa for the ist 2 hours–the fed closes usa markets

(#2) Aussie J: thanks for the heads up re: pomo

(#3) Aussie J: great point about ” europe opens usa

for the first 2 hours and then the fed closes the usa markets.

Actually what happens is that the bond market in Chicago

closes one hour before the NYSE, therefore the Dow, Nas,

S&P tend to take on a life of their own in the final hour

of trading. Neal can confirm this for me as he is the

undisputable Chicago maven.

Thanks Howard,

as a daytrader u get to know the times

11.30 am markets go dead -europe closes but their after hours goes to noon

–ur guys take a long lunch hour but back to close the oil pits/bonds ect at 2.30

–traders move to shares

computers take over for final hour,with buy/sell orders fireing off every 10 min starting at 3.10

plus throw in a few humans closing possitions ext

now that the ECB has stoped fiddleing with the usd for the nite we may get some sence out of the markets