Good morning. Happy Wednesday.

The Asian/Pacific markets closed with solid across-the-board gains. Europe is currently posting similar gains. Futures here in the States point towards a large gap up for the cash market.

I’m one to accept prices as is and not ask questions, but if you want to know, good economic news out of China is one reason for today’s excitement. Also the dollar is finally giving some of its recent gains back, and the euro is up.

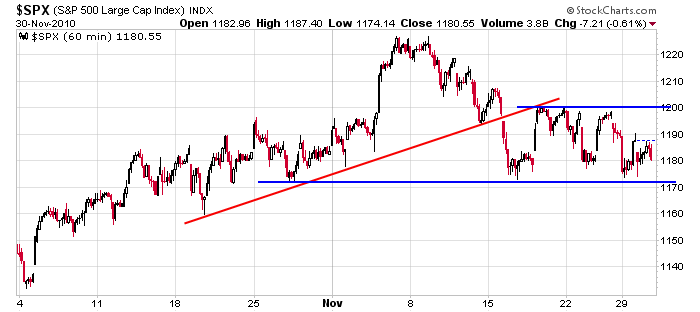

Here’s the 60-min SPX chart. Neutral…and the longer the range lasts, the more neutral it gets. Other than a quick move above 1200 and a drop back into the range, the index has traded between 1170ish and 1200 for about 7 weeks.

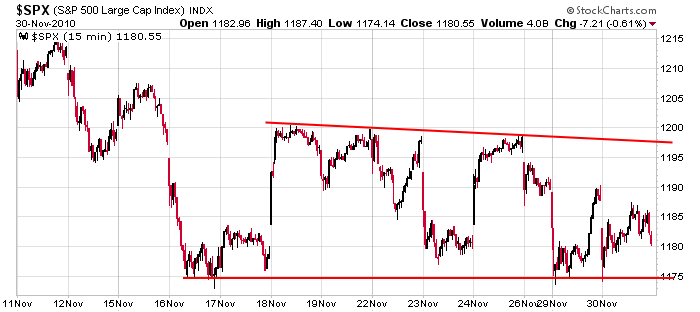

Here’s a closer look with the 15-min chart. As of now, today’s open will be near 1195…lots of resistance up there. Bearishness has grown the last couple weeks, so lots of shorts will be trapped at today’s open. If the market doesn’t drift back at some point this morning, short covering alone could push the market above the range over the next couple days.

I’ve been playing it safe the last couple weeks. It’s my belief trading goes in streaks. You fight to survive during the challenging times and then get aggressive when the trend is obvious. Lately I haven’t seen a reason to be aggressive.

Today will be a semi important day…can the market hold most of the gap up gains? We’ll see. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 1)”

Leave a Reply

You must be logged in to post a comment.

to bullish for me –im going back to bed

could be said the usd has made a 3 way push to the upside and is due for a pull back

meaning the bulls can have a little play with their toys as shares go up —for a short while

Does anybody remember the seasonality effect? God knows

I’ve posted it here 3 or 4 times. Today is December 1st,

so the hedge funds, pension plans, etc. are all buying due

to their contractual obligations to the fund holders.

Neal: It’s just a market folklore that I have been following

for a long time. Whenever the market goes ‘up’ or ‘down’ a quick

analysis should prove to be correct. In this case the easy

move is a 200 point rise in the Dow and then we’ll see what

sort of follow through we have over the next few days. HW

Will to hell with market lore. This is little bleep up is the result of speculators who think they see an economy recovery – read employment gains- off in the distance, they overlook seasonal employment leaps and the lack of a generally improving set of asset numbers that will support more hiring. They is also a little excitement over the prospects for a disciplined Congressional policy. I don’t understand why that might be true; it is probably an illusion, we are stuck with QE2 and whatever it does is the whole fix for this year to 2012. I see a little dip into Dec low, and after that its all up to the news makers to drive the market.

Neal, up now ready to short the bulls if we get a late sell off–we are now high enough ,but probably tomorrow or when ever the move turns

im not a possition trader or a swing trader—-IM A DAYTRADER

XXXXX–SO I CAN TRADE WHEN EVER I WANT

go the bulls go a little higher –i dare u

its all about the usd which hit the 80.50 sup and the euro , which was due for a bit of a counter trend—nothing to do with stocks or fundamentals

but fundamentals can move a currency

Neal: What do you mean by ‘the public is not in’

Who the hell is buying this market? Martians from

outer space? ‘Ground control to Major Tom….’

‘Ground control to Major Tom’. All rockets systems

currently turned on. HW