Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed – Hong Kong and India dropped more than 1%. Europe is currently mixed. Futures here in the States point towards a flat open for the cash market.

Some are calling yesterday a reversal day…the indexes opened in new high territory and then dropped and closed near the intraday lows. I think it’s entirely possible we have some weakness in the near term, but I don’t expect the trend to reverse. The news-induced gap up makes the charts look much worse than they actually are. The S&P had moved 60 points in less than a week…a brief pullback isn’t anything to be concerned about.

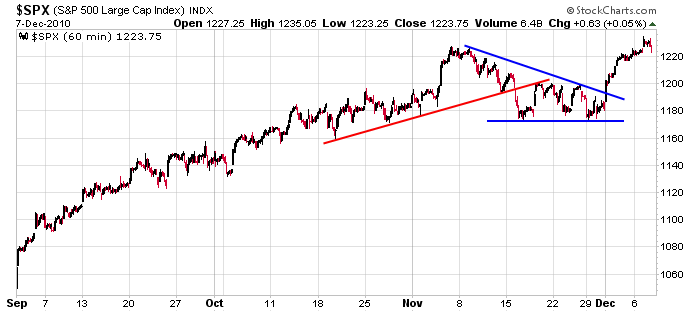

Here’s the 60-min S&P chart. A little backing and filling is perfectly fine, but I’d rather not see the index fall all the way down to 1180 and fill the Dec 1 gap. If the market is strong, the S&P should not drop that much.

My stance remains the same. I believe we are in the beginning stages of a move up and we can shoot for bigger gains instead of quick little gains. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 8)”

Leave a Reply

You must be logged in to post a comment.

Not constructive on this market. Too much on taxes and EQ at loose ends. We must be in a holding pattern for a time, likely into Jan 2011.

Longer range I am still concerned over deflation the tax propose notwithstanding. The issues in the EU are not resolved and China is busy attempting to slow inflation. None of this is good for recovering industrial economy.

Wait and watch to see what Dec brings.

u are right Jason ,even if we went down to 1180 spx,the trend is still up,but are u suggesting that we shouldnt take advantage of the LARGE profits to be made in such a move

i trade cfd’s the indexes at 100 to one leverage and even with 100 usd per point on say dji,then thats a lot of money

i like ur blog as it is so common sence and u talk market internals too ,which not many others do

but with such large leverage unfortunatly i have to be on the ball and daytrade it

sometimes if the trend or counter trend is with me i will stay over nite

i dont trade opts or stocks

i respect that others may be longer term than myself and if i was trading different instriments ,then maybe i would be too