Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up, but India and China lost more than 1%. Europe is currently mixed. Futures here in the States point towards a positive open for the cash market.

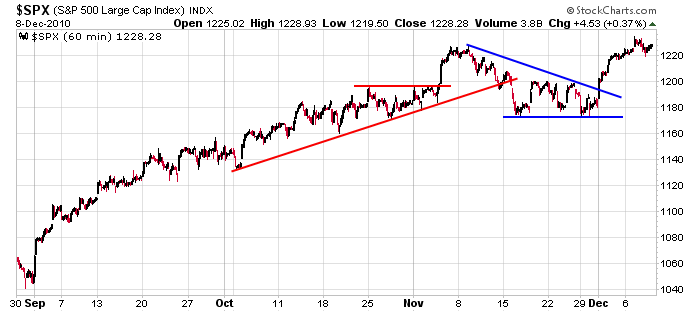

The S&P has closed within a 7-point range for 5 straight days. Not bad and not too much of a concern considering the index moved 60 points off its low in less than a week.

There hasn’t been much to talk about recently. During November, even though the market traded range bound, the indexes gapped almost every day and swung wildly in both directions. Then they rallied hard the first several days of December. Now the action is muted and market-moving news items are coming out at a much slower pace. After this little soft patch, I expect prices to continue higher into the end of the year and beginning of next year.

Here’s the 60-min S&P. It’s pausing near its November high. No big deal. I don’t see this as a problem. The chart looks good to me.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 9)”

Leave a Reply

You must be logged in to post a comment.

The pressure is clearly to the up side. But why? The cynical belief that the Fed and the congress are pumping the economy with about 1.5T dollar stimulus for the next year or so, dpending on the life of the tax extensions. This plus the bond scare has a lot of liquidity in the equities. Bernanke can not figure out what is causing yields to rise. Bond yields should rise, but rise in a bubble that will see little real growth, nominal yes. The Fed can not be trusted to manage its QE.

Why to do? PMs and technology that will compete well in the global markets. I am on the train, but I had hoped it would slow and support a more responsible growth path.

Not too happy with 2011 prospects.

Just like anything else, of course. Whenever you have plans on paper

and then you deploy them out into the field two things are likely

to occur: a) you can tweak it a little bit once it get’s rolling

(i.e., QE2), or if it winds up being an abysmal failure (i.e.,

double dip recession), it’s time to stop the bleeding and get

rid of Bernanke once and for all. We are going down next year

maybe, uuuh, mid to late January, etc. HW