Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down, but China and India gained 1%. Europe is currently mostly up, but gains are small. Futures here in the States point towards a moderate gap up open for the cash market.

The market is in good shape. Yesterday, on a closing basis, the Nas, S&P and Russell closed at a new high. Not bad. The thing I’m wondering now is whether people are too bullish, if they’re too complacent. It’s possible too many expect a big rally into the end of the year. Because of this, I wouldn’t be surprised to see a sudden and quick correction to at least make the bulls question themselves.

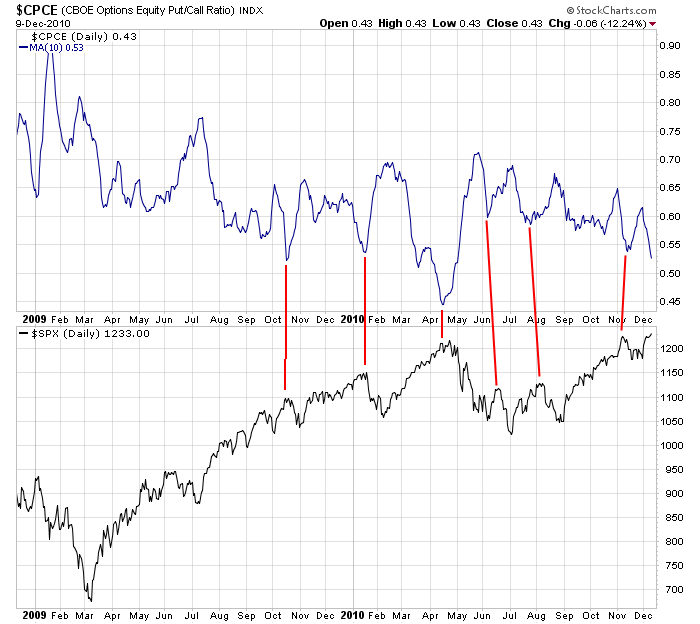

Here’s the 10-day MA of the equity put/call vs. the S&P. Dips in the PC have matched up pretty well with tops in the market, and given the PC is at a 7-month low, we have to start being on the lookout for a counter move.

If such a counter move were to play out, I’d expect it to get bought up. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 10)”

Leave a Reply

You must be logged in to post a comment.

The way you stated your opinion that we might see a correction sounded like big brother is out there to teach us a lesson. Who or what has the power to do these things, and why?

Not picking you apart, but I have never gotten a real handle on this subject.

There are no big brother implications there…just that we may be getting close to a time when there are too many people stacked on one side of the market, and when that happens, there’s usually a little shake out. Those who are bullish have already taken their positions. They then become cheerleaders. Who left to buy?

Just in case Neal wants to know, ‘I’ve got

a date with a fig on prune street.’ HW

The Asian/Pacific markets closed mostly down, but China and India gained 1%.

I thought China and India were the Asian/Pacific markets.