Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

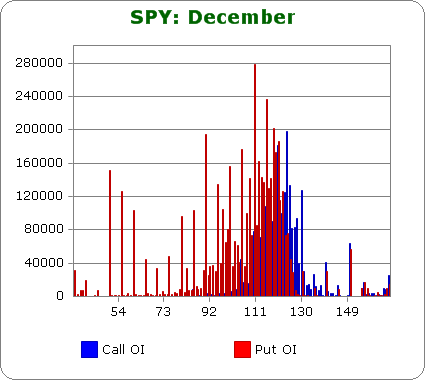

SPY (closed 124.61)

Puts out-number calls 2.1 – slightly less bearish than last month but bearish sentiment remains high.

Call OI solid from 115 up to 130.

Put OI is huge at 124 and below.

With SPY closing at 124.61 today, some call buyers are definitely going to make some money this month. Put buyers on the other hand are going to lose almost everything if SPY closes right here. Max pain? Since puts far out-number calls, we need to focus on how much SPY can move up while allowing call buyers to make as little as possible. I’m going to call that level 122 which is a couple points below today’s close. So slight downward movement the rest of the week is needed.

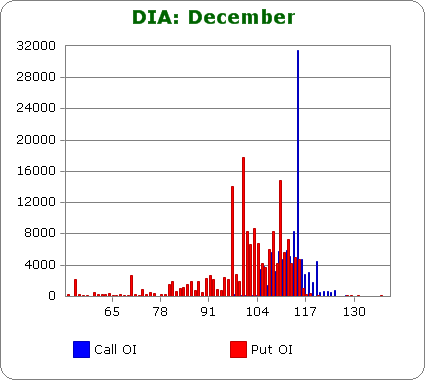

DIA (closed 114.49)

Puts outnumber calls 1.7-to-1 – much more bearish than usual. Typically it’s 1-to-1.

Call OI is steady (but less than put OI) between 110 & 116 with a huge spike at 115.

Put OI is steady at 115 and below with spikes at 110, 100 and 97.

That call spike is just above today’s close. DIA can’t move too much above it or else those buyers will make money. But DIA also can’t fall much because put OI is pretty steady at 115 and below. Hence flat trading the rest of the week will cause the most pain.

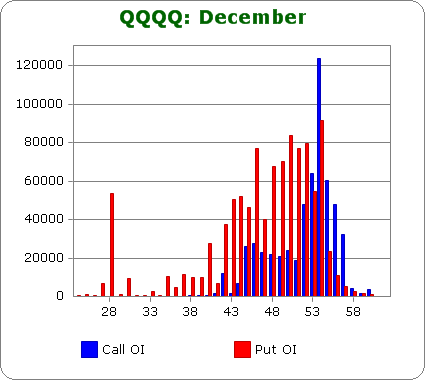

QQQQ (closed 54.31)

Puts out-number calls by 1.9-to-1 – slightly less bearish than last month.

Call OI is highest between 52 & 56.

Put OI is highest between 42 & 54.

There’s some overlap between 52 & 54. A close somewhere in the middle would cause the most pain. With today’s close at 54.31, some downside is needed to accomplish the mission.

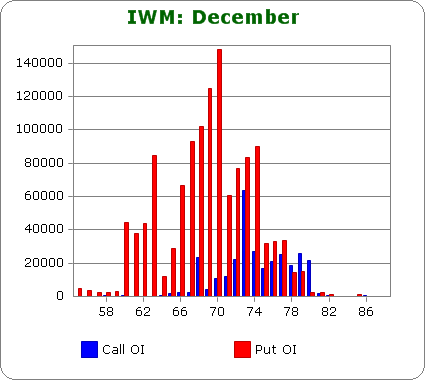

IWM (closed 77.35)

Puts out-number calls by 3.4-to-1 – slightly more bearish than last month.

Call OI is highest above 72, and there’s a spike at 73.

Put OI is huge at 74 and below.

With put OI so much greater than call OI, let’s focus on the puts to determine what will cause the most pain. Put OI is strongest below 74, but there’s decent OI at 75, 76 and 77 too. A close above 74 would be sufficient, but a close above 77 would be even better. With the stock closing at 77.35 today, flat or moderate down action the rest of the week would do the trick.

Overall Conclusion: Once again put OI far out-numbers call OI, and unless most of the put OI is selling, not buying, the bears will once again get clobbered. The market is already positioned to cause lots of pain, but per the numbers above, call buyers will make a couple bucks. Flat trading the rest of the week will cause lots of pain. A small move down would cause even more pain.

On another note, in many cases, put and call OI for Dec 31 was much greater then for this Friday. I’m not sure how those end-of-quarter and end-of-year options effected the normal Dec expiration. They (the Dec options) don’t seem to have skewed the numbers too much.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

I guess we know about where this week will end. They rarely let us down. Coincidence, I am sure.

the bigboys instos are increasing their bearish bias whilst the retailers are still buying like hogs

last nite was typical for mon before opts and bigboys selling strength

go the pump and dump

Jason, please answer following question:

How the VOLUME of options traded you can interpret as a volume of sellers or buyers?

“Once again put OI far out-numbers call OI, and unless most of the put OI is selling, not buying”

Where did you get info that most of volume represents selling of options, not buying it?????

thanks for answer

Alex

Alex…I never said the volume is either buying or selling. We actually don’t know the answer to this question.

Read what he said again. Note that he said “UNLESS” not “IS”