Good morning. Happy Tuesday. Happy Fed Day.

The Asian/Pacific markets closed mostly up – gains were small. Europe is currently mostly down – losses are small. Futures here in the States point towards a flat open for the cash market.

At 2:15 ET the FOMC announces their overnight rate policy. Currently it’s pegged between 0 & 0.25%, and this isn’t expected to change. Their statement on the other hand could move the market.

In my opinion, unless there’s a major change in their statement (very unlikely), the market is in good enough shape to shake off and absorb any declining price action the next few days. After all, they almost never change market sentiment. They may induce a temporary hiccup, but they don’t permanently change things.

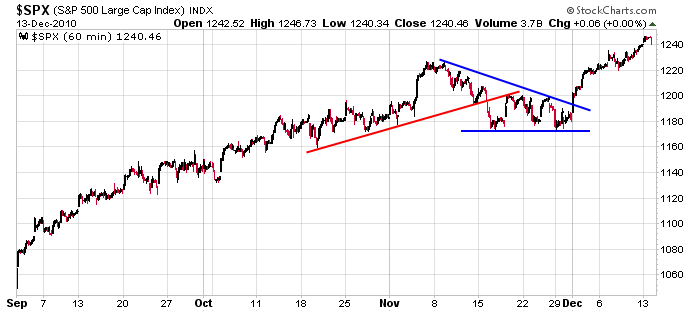

Here’s the 60-min SPX chart. If by chance the market wanted to rest (it will need to rest sooner or later, even if the Fed says nice things), a drop to 1190-1200 would not destroy the uptrend.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 14)”

Leave a Reply

You must be logged in to post a comment.

market flat until 2:15pm eastern time. short walk

with my dog Max in the freezing cold until then. HW

Neal: I got a buy signal inside the VIX with the 30 year US bonds.

What about the ETF Proshares symbol UBT hovering around 77. HW

I meant to say falling back inside the bollinger bands

thus creating a buy signal on the 30 yr US T-Bonds. HW

Maybe a correction is due.

But my work says 2011 could be a rush based on EQ2 and the utterances of the Fed today.

Best to be in stocks.

US Steel (symbol X) getting way overbought.

May be time to short this stock. Feedback

appreciated, and somebody have any good

shorting opportunities out there for me

to check out today. HW