Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and with a bearish slant. Europe is currently mostly down, but losses aren’t great. Futures here in the States point towards a negative open for the cash market. This comes off a day the market sold off after the Fed statement but then rallied the last 30 minutes into the close.

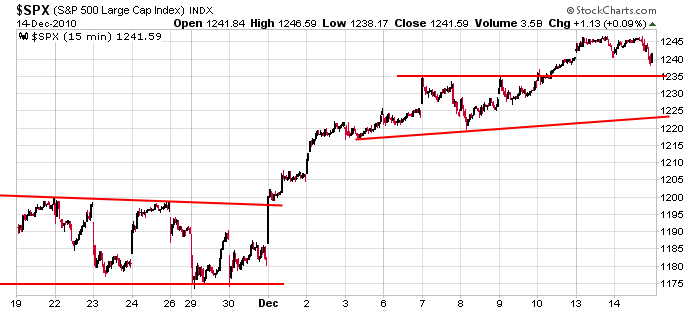

The market has done great this month. The S&P has moved up 9 of 10 days and is up about 60 points. It certainly deserves a break in the near term, but overall I expect the trend to continue. At the beginning of the week, open-interest data suggested a flat market this week would cause lots of pain, but a slight move down would cause even more pain. This is what I’m playing for. Given the extent of the move off the Nov low, I don’t want to chase stocks up right now. I’d rather let the market move sideways or do some backing and filling first. Stocks that broke out two weeks ago had lots of time to follow through. Stocks that break out now will have a much tougher time.

Here’s the SPX 15-min chart. If the market wants to pull back for a couple days, my target is 1225.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 15)”

Leave a Reply

You must be logged in to post a comment.

I hear u Jason, just saying rather than ride the rollercoaster here, would have been better off listening to Mr. Weintraub and just staying long for this whole rally. Yes we’ll probably move higher but I’m not buying it here, not now!

(#1) Tom Power: what is your prognostication? how high do you think the Dow

will go before we turn around and go down to….uuuhh….let’s say 10,000. HW

Right down to your upper support line, Jason. Pretty doggone good analysis.