Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed down – China lost 1.4%. Europe is currently posting solid gains. Futures here in the States suggest a moderate gap up open for the cash market which will put most of the indexes into new high territory.

I’m sure you’ve heard it 1000 times…this is a strong time of year for probably two reasons. 1) People don’t want to sell because they have to pay taxes sooner rather than later (much better to wait until January). 2) Fund managers whose jobs are on the line are desperately trying catch up. Otherwise they’ll be part of next month’s unemployment numbers (not really but you get the picture). So buying by fund managers and a lack of selling by everyone us allows the market to move up this time of year.

My bias stays the same as it’s been all month. Short term anything goes (This is always the case, Leavitt Brothers is not a day trading service). Over the intermediate term, the trend is up, and although there are a couple warning signs, my bias remains firmly in the up direction.

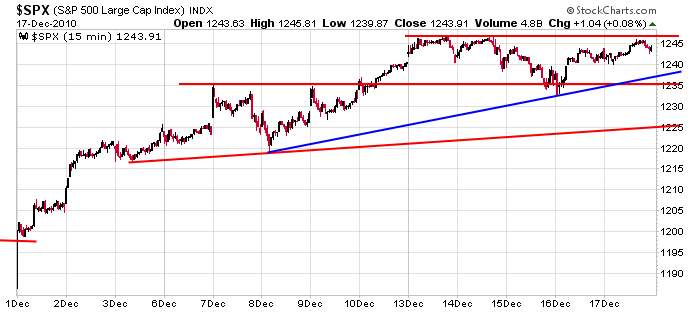

Here’s the 15-min S&P chart. Today’s open will be above last week’s high. The short term target is 1255 and then 1265. Downside supports are shown. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 20)”

Leave a Reply

You must be logged in to post a comment.

Wow! It’s official. I just became the official secretary

for Neal and his phantom website, Dow 12,000. HW

American Express is really getting whacked today. In fact,

the stock looks like it’s imploding. HW