Good morning. Happy Tuesday.

The Asian/Pacific markets closed with solid, across-the-board gains. Every index in Europe is currently up. Futures here in the States point towards a gap up open for the cash market.

I feel like a broken record, but the reality is not much has changed the last week. The trend is solidly up, but complacency is at an extreme too. The time of year says stay long, but something’s got to give eventually. No doubt fund managers are chasing performance to save their jobs, and there are others who are resisting taking profits so they can delay paying taxes. The first couple weeks of January are setting up to be interesting and important.

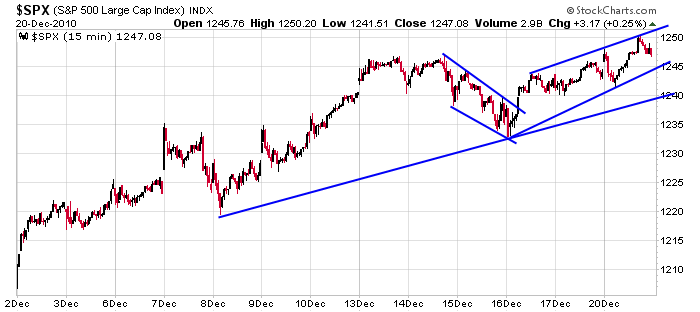

I see no reason to guess a top although you could argue scaling back on the long side is wise. Here’s the 15-min S&P chart. A new high was made yesterday, but a bearish wedge is forming. I don’t have an upside target in mind (per this chart), and if the index wishes to give a little back, downside targets are 1240 and the Dec 15/16 low.

That’s it for now. I said 3 weeks ago it was better to buy and hold rather than trade in and out because when the market trends it’s much easier to nail a couple big moves rather than nail dozens of little ones. And when the market trends, I don’t typically have much to talk about because it’s the same old same old every day.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 21)”