Good morning. Happy Monday. Hope you had a nice weekend.

Several Asian/Pacific markets were closed today. The ones that opened finished up. Europe is currently up across the board – there are several 1% winners. Futures here in the States point towards a big gap up open for the cash market which will put many of the indexes at a new high.

I don’t know about you, but I’m glad the holidays are behind us. Two weeks of slow trading is 9 days too many. There are many things that need to be worked out, so I’m anxious to see what happens in the next couple weeks. The trend is solidly up, but many indicators are issuing warnings. Complacency is high and fear is low – a decent contrarian indicator. Something has to give. The market has been on hold waiting for the calendar to flip. So here we are. No more excuses. Let’s see what happens.

I’m long, but as I stated a few times last week, I’m being on my toes. That means there are strong unknown forces that could easily push prices in one direction or the other.

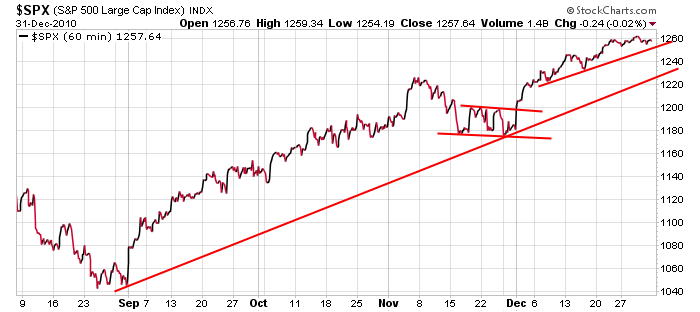

Most of the index charts look something like this 60-min S&P chart…the index has a cushion…it can move down and still maintain its uptrend.

Ok, let’s see what the new year brings.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 3)”

Leave a Reply

You must be logged in to post a comment.

“Ok, let’s see what the new year brings.”

I predict by 2015 the U.S. will adopt the metric system.

The US will convert to the Metric System when and if they are forced to convert. Just think of the cost of changing all the speed limit signs. The cost of conversion would be staggering, to say the least. The US won’t be converting anytime soon.

(#1) RichE: I hate to bust your bubble, but I do remember this:

I went to DeWitt Clinton High School in 1971. My science teacher

predicted in 10 years from now the U.S. will be on the metric

system. I hope you didn’t throw away your old Simon & Garfunkel

albums. Paul Simon is older than Art Garfunkel. Henceforth,

the reason their name is positioned that way. HW