Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Europe is currently down across the board – many indexes are down at least 1%. Futures here in the States point towards a moderate gap down open for the cash market.

On Monday the market was strong early and weak late. On Tuesday it was weak early and strong late. Heading into this new year the trend was up, but there were plenty of warning signs keeping us on our toes. It wasn’t a time to sit back and be comfortable. We’ve gotten a little for both the bulls and bears. For the bulls, a new high was made. For the bears each move up so far has been sold into. The bears are trying to take control, but the bulls won’t go down without a fight.

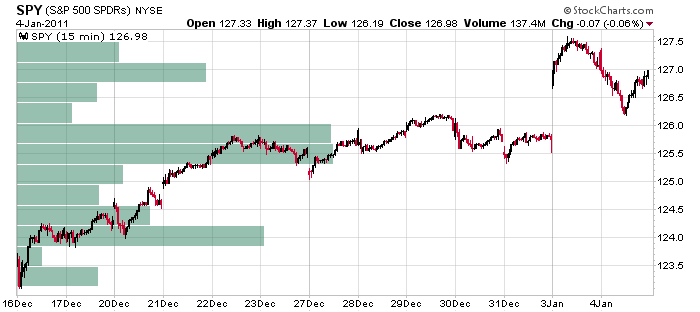

Here’s the 15-min SPY chart. Today’s open will be near yesterday’s low. Odds favor any rally attempt getting sold into until Monday’s gap up fills.

That’s it for now. I’m not taking big chances here. The market is trying to figure out what it wants to do.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 5)”

Leave a Reply

You must be logged in to post a comment.

The ADP number is significant only insofar as we have a trend in their series. The numbers themselves suggest that the mid size employers are going to do well, and that small cap stocks are the play for now.

But this data has a great deal of seasonal response that may not hold up, the fall of 10 rally was hope based, the spring of 11 rally will be faith based on a very short time series.

Over hanging all of this is the EU. and China. I will play the long side in small cap and watch the commodities carefully. I particularly like corn and the grains in general. World food prices are historic highs. This can last six months.