Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed – Japan gained better than 1%, Indonesia lost more than 1%. Europe is currently up across the board with moderate gains. Futures here in the States point toward a positive open for the cash market which will put most of the indexes at a new high and allow the Russell, which has lagged lately, to inch closer to its own new high.

In my opinion there were two top stories yesterday. 1) The fact that the Dow, Nasdaq and S&P 500 made new highs while the Russell 2000 small caps did not. One day doesn’t mean anything, but if the small caps are still lagging a week from now, I’ll definitely question the market’s upside potential. 2) Most of the indexes made a new high on a day the dollar was up big. These two entities have moved opposite each other for a long time, so either something has to give here or they’re getting divorced. But like point #1, one or two days doesn’t mean much to me. I don’t sit at the edge of my seat and panic every time things don’t fall nicely into place.

Tomorrow before the bell the Labor Dept. releases the latest employment numbers, so today may be on the slow side.

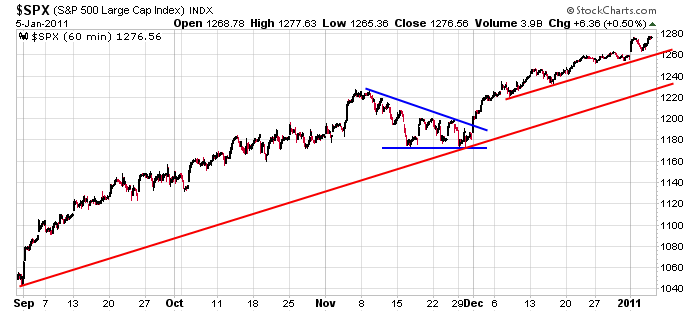

Otherwise my stance is the same. The trend is up, but I’m being on my toes. Here’s the 60-min SPX chart going back to Sept. I really don’t understand why traders try to guess tops when the trend is so strong.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 6)”

Leave a Reply

You must be logged in to post a comment.

There are these so called ‘turn cycle’ dates, and oddly enough we have one

coming up tomorrow, 1/7/2011. So that means if we are going ‘up’ into a

turn cycle date the next move is a pullback of some sorts. And if we are

going ‘down’ into a turn cycle date the next likely move would be up. HW

If you trade using margin, as a day trader you don’t

pay a thing. Provided you close out your position

by the end of the day. HW

who was that who said 1300? … 300 points ago!! 🙂

What is the M.O. for an INDEX? What should each INDEX be doing within an economic phase? Wouldn’t an amalgamation of the INDEX’s indicate an economic phase and wouldn’t that give clearer insight to the trend of an individual index? Granted, it’s a which came first the chicken or the egg, the indicator or the economic phase, but bouncing the two back and forth seems it would produce a better understanding/guess.

Neal: It sounds to me like you’re getting your

ass kicked today on something. Whassup assman!

Hi Jason,

Your comments at StockTwitsU post are not w/o merit…I replied as best I could. Thanks for speaking up