Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Europe is currently up across the board – there are several 1% winners. Futures here in the States point towards a moderate gap up open for the cash market.

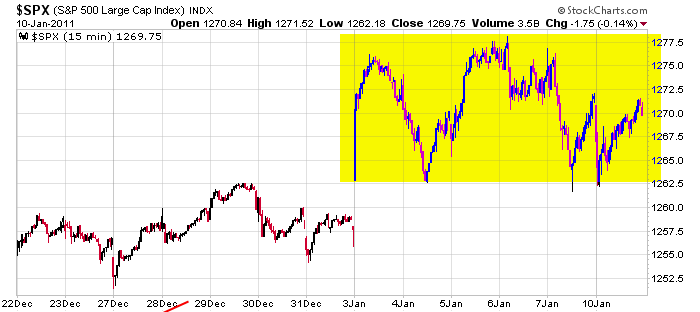

We entered the new year with lots of questions. The trend was solidly up, but there were several warning signs in the form of indicators which weren’t confirming the market’s movement and divergences. This is what we’ve gotten. This is the 15-min S&P chart. Up down up down up down up. For 6 days the market has been trying to ‘right’ itself and in the process is up nicely. No complaints here. The market is much more boring and moves much slower than you think. It takes time for things to play out.

6 days of consolidation at a time the trend was super strong but non confirming indicators were present is not a bad thing. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 11)”

Leave a Reply

You must be logged in to post a comment.

Are there any experts out there when it comes to those good old Bollinger

bands? Well, they are tightening up again and for my money we’ll either

break to the upside or downside soon. Apple may (just might?) implode

from these levels, so watch out. Check the beta on Apple before you do

anything stupid. HW

Just the confusion is a warning. The EU up turn is only temporary. The sales of bonds to the ECB is mother’s kiss, but no endorsement of the path taken.

Caution – but invested is probably right. Still think a correct is probable given the negative indicators. Overall a modest year seems likely but we are riding the news ticker, so anything can happen.

(#1) WidBey: I think that the sale of bonds to the ECB

is not ‘mothers kiss’ but more characteristic of

throwing good money after bad. HW

Yes, brothers and sisters. Two years ago on New Years eve

I did indeed make a resolution to stop drinking. So far it

has worked, but only with the grace of God and the 12 step

program. HW