Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board; there are a couple 1% winners including Hong Kong, India and Indonesia. Europe is also up across the board; most indexes have gained more than 1%. Futures here in the States point towards a moderate gap up open for the cash market which will put most of the US indexes at a new high.

The big news is Portugal’s bond auction went very well. The country was easily able to raise the money they wanted, so I think many are breathing a sigh of relief that the country doesn’t need a bailout, at least not now.

The situation here in the States remains the same. The trend is rock solid, so I can’t think of any reason to go short or to try picking a top. But there are many warning signs out there I wish would right themselves before the market attempts another leg up. I know, I sound like a broken record. This has been the situation for a couple weeks. It is what it is, and I’m not going to complain because we’ve had many good set ups to play. There seems to be an invisible hand under the market that won’t let it drop. Every little dip gets bought, and we gone almost 30 consecutive days without at least a 0.5% one-day drop.

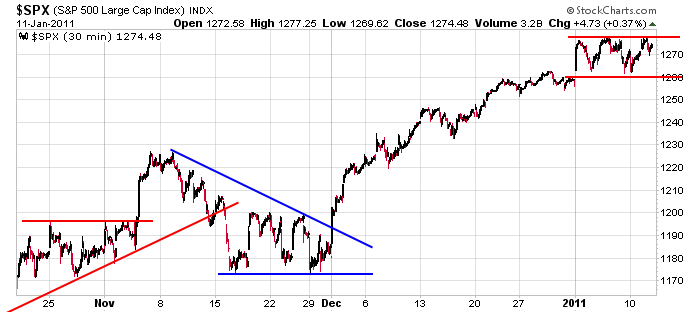

Here’s the 30-min SPX chart. Today’s open will be above the 7-day consolidation pattern…I hate breakouts that involve a gap.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 12)”

Leave a Reply

You must be logged in to post a comment.

The market should be operating on fundamentals, not the news.

Come Thursday, tomorrow, what will it be in the news media

that will dictate the direction of the market for the

rest of this week? Caution is advised, but the direction

is still remains up. What happens in Vegas, stays in Vegas. HW

its time to feed the bears,Neal

Neal

u should listen to Jason–its still time to be carefull and breakout that gap up often fail

SILVER: What’s the consensus on silver and any experience with Gordon Scott Venters of

United States Metals Corporation

Thanks

Thanks