Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Europe is currently mixed and without any noticeable winners or losers. Futures here in the States are flat.

Yesterday the S&P broke out of its 7-day range but then went nowhere. The Russell also made a new high, so the negative divergence between the small caps and large caps has been negated (I stated over the weekend this divergence plays out over a couple weeks, not a single day).

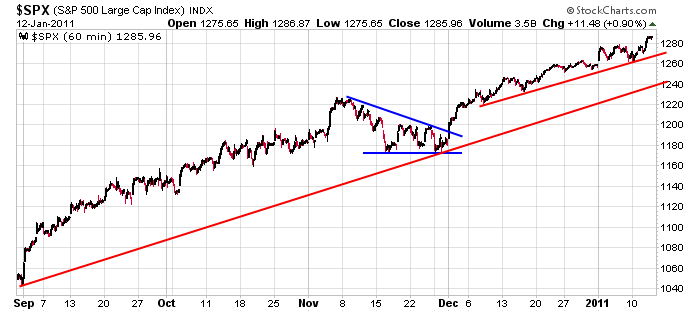

Here’s the 60-min SPX chart. The market has been pretty boring because we haven’t gotten much up and down movement. It’s been mostly up, and that’s why I’ve repeatedly said it’s better to take good positions and hold than try to trade in and out. The big money is made riding the big trends while sitting on your hands, not over trading.

No need to over analyze things. Sooner or later we’ll have stiff down day or down week and the bears will come out and say: “I told you so”…if the bears have any money left. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 13)”

Leave a Reply

You must be logged in to post a comment.

There is reason to beleive that the Dow is headed for 12,000

although the internals seem to be weakening. So, henceforth,

a strong down day or even a strong down week is looming

somewhere in the distance. HW

As long as the fed has money the market will rise. It is just a nominal adjustment no one is better off in this zero sum game where one hand gives to the banks and the other takes it away in food and energy. The rest of it is likely to decline – it is called stagflation by sectors.

Best to own the indexes and ride.

Neal, thanks for the SILVER comment. Anyone else have any sterling advice on investing in silver? Thanks in advance.