Good morning. Happy Tuesday. Hope you enjoyed your long weekend.

The Asian/Pacific markets closed mixed and with a slight bullish bias. Europe is up solidly across the board – there are several 1% winners. Futures here in the States are flat relative to last Friday’s close.

We are halfway through January, and so far, so good. If the first week of January is a good predictor of the rest of the month and the entire month is a good predictor of the rest of the year, things are looking good. Personally, even if such ‘tells’ exist, I do not under any circumstance blindly follow them. In fact I don’t even pay much attention to them regardless of what historical facts says.

On Friday everything closed at a new closing high, so those who have bought and held in an attempt to milk this move for everything it’s worth are in a good situation here. Those who’ve tried picking a top and have been in denial are once again getting crushed. Having said this, I’m staying on my toes. The S&P has been up 7 straight weeks and has spent more consecutive days above its 10-day MA than any time in history. We know the Fed is providing a little support for the market, but eventually that’ll go away and profit taking will kick in. I’m long but not exactly sitting back and allowing myself to feel comfortable.

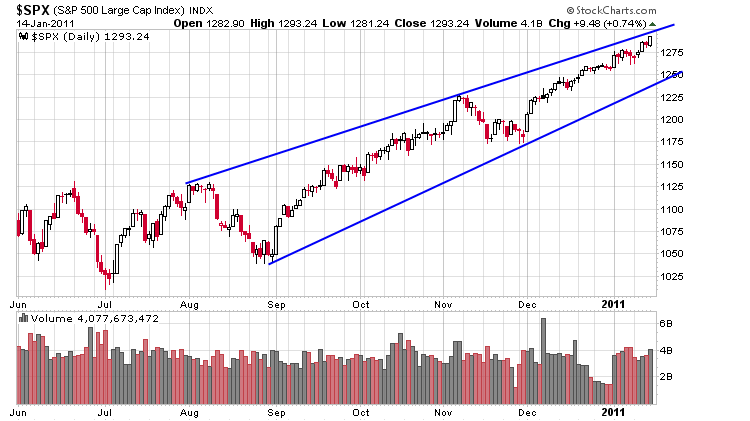

Here’s the S&P daily. A line drawn through the last two highs suggests we may have resistance just over head.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 18)”

Leave a Reply

You must be logged in to post a comment.

I will not sell Apple until it slides 8%, then I will sell the hell out of it, short it too. Jobs knows something he is not telling us. Imagine Iphone 5. This is getting silly and it will not go to the sky with constant baiting of consumers.

Oh will, I am expecting the market to rise to 1320 more or less.

Be patient, things are different than you think. Just how is not known.

You stated:

“Fed is providing a little support for the market…”

A LITTLE????

Also:

“The S&P has been up 7 straight weeks and has spent more consecutive days above its 10-day MA than any time in history…”

A LITTLE???

1. The Fed/POMO/PPT is providing an ‘unquantifiable’ amount of money

to support the markets. It’s like taking a drug, you know. How do I know!

The effects work well in the beginning, then they lose their viscosity,

and then eventually the drug actually becomes ‘counter productive’ no

matter how much more you take of it. 2. If people are selling Apple stock,

who the heck is buying it right now? That’s the question! Neal, answer me!

The last time AAPL traded at 199 was last March. As of Friday’s close the stock was up 75% since than. Guess what? There have been hundreds of stocks that have done much better over a shorter time period. AAPL is a great company, maybe the best in the world, but who cares. The only thing that matters is how much the stock moves, and for that, there are better trading candidates out there. Don’t get caught up in ticker symbol. It means nothing.

Hi Neal! 1. I only have one dog. His name is Max.

2. I recently started taking a laxative by the

name of Dulclax. You must be reading my mind,

or, we are commoonikating by mental telefapee.

From IVolatility.com

S&P 500 Index (SPX) 1293.24. From close-to-close, the SPX advanced 35.60 points since our last market review. The only overhead resistance is now more than two years ago at 1303.04 on September 1, 2008 so it looks as if SPX will most likely continue higher. If there is a correction however, here are the points to be watching. First, there is near term support at the January 6 high at 1278.17. Second, there is a well-defined two point upward sloping trendline from the August 31 low at 1040.88 touching the November 29 low at 1173.64. Therefore, the next point of concern would be a close below 1249, putting this trendline in question. After that, the next short- term support is the November 5 high at 1227.08. These three points provide an opportunity to design a hedging strategy anticipating the next pull back that is surely to come at some point. See the VIX Options and Strategy sections below for more details.

E-mini S&P 500 Futures (ESH1) 1289.50. Since expanding open interest is required to support the current trend the bulls should be encouraged to see it has expanded by 58,714 contracts since December 31to last Thursday January 13, even after some long liquidation on Thursdays small 2.25 point price decline.

The market had a great excuse to tank today, but nevertheless Europe

is up on the overnight and the Dow is also up. I tend to agree

with RichE on this one as well as the talking heads on CNBC.

We’ll probably reach S&P 1300 sometime this week and then I’ll

call upon the market Gods to figure out whassup & goin downtown. HW