Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and with an upward slant – China and Hong Kong gained over 1%. Europe is currently mixed – there are no big winners or losers. Futures here in the States point towards a flat open for the cash market.

The January rally is finally starting to show up in the stats. Yesterday 234 stocks from the S&P 1500 made a new 52-week high. This is the highest number since the first day of the year and second highest data point since Dec 13. There were no new lows. We also got the greatest number of stocks made 10- and 20-day highs since Jan 3.

But while new highs and new lows are moving in the right direction, another stat has moved into nose bleed territory. It’s the number of S&P 1500 stocks trading above their 200-day MA. The number now sits at 1329 – the highest level since Apr 29 which happens to be the day before the market started selling off last spring.

I’m not predicting the same will happen right now. I’m just noting the extent of the current move is getting ridiculous and although I’m long, I’m staying cautious.

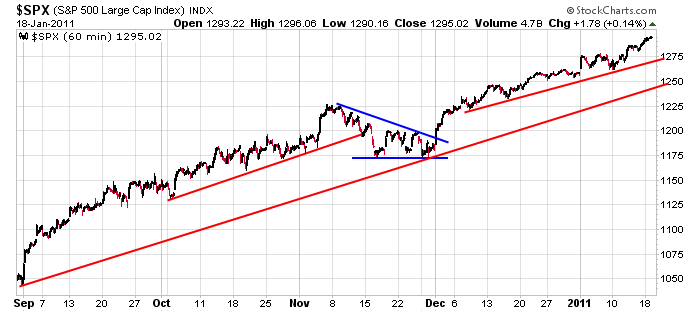

Here’s the 60-min S&P chart…as steady as you’ll every see. A move to the line that connects the Sept and Nov lows would constitute about 50 downside points. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 19)”

Leave a Reply

You must be logged in to post a comment.

i think every cab driver knows the market is rig.ged and even general ben was publicly boasting that he had turned the market in 09 and now caused this irrational exuberance–in oz that would be a criminal offence.—actually it was barny franks with his mark to fantasy for the banks that turned the market

we know the retailers are bullish hedged with calls and the instos are starting to hedge for down

so when are they gunna make their move—dji 12000

The indicators suggest that we will see some correction. Put Call says danger.

The problem is the feet of clay thing: or GS syndrome: Yes, we are in recovery, but you can not see it in our earnings. Odd. Just a bump in the night, or a heart attack?

Goog is still the bellwether for tech with some AAPL help. But careful here.