Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mostly up – there were several 1% winners. Europe is currently up across the board – several 1% gainers there too. Futures here in the States point towards a moderate gap up open for the cash market.

The President gave his annual State of the Union speech last night. It seemed a little more serious than in years past, and with members of both parties sitting together as opposed to on opposite sides of the room, there was much less polarity. As usual the President says American is strong (blah blah blah), and he proposes lots of investment (spending). The problem with spending is it won’t be long before our debt gets so big, all money collected via income tax will not be enough to pay the interest on the debt. Then what happens? Maybe it’s because our elected officials have to rerun for office every 2, 4 and 6 years that everything they do is short term.

Today Bernanke and company will announce their desired level for overnight rates and the discount rate. No rate change is expected (it would be shocking if they changed rates), so market participants will again be focused on the statement. But let’s remember what the Fed says often causes some movement in the near term but almost never changes the market’s overall sentiment.

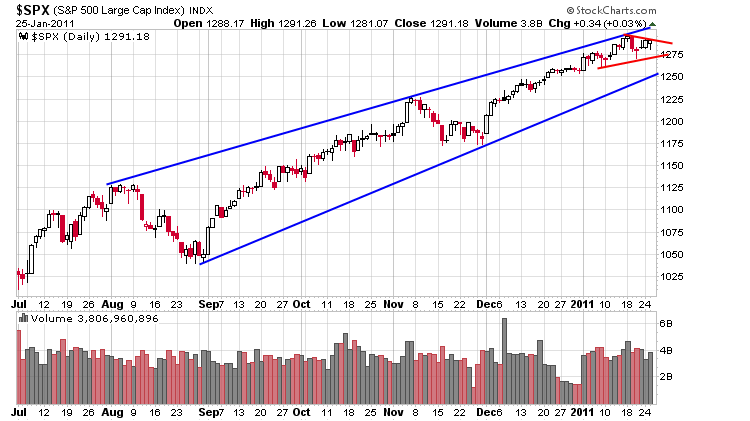

Here’s the daily SPX. January has been a pretty good up month, but the last two weeks have been sideways. Should the market decide to pullback, my first near term target is 1250. Upside target is a new high.

I remain net long, but I’m in conservative mode.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 26)”

Leave a Reply

You must be logged in to post a comment.

The state of the market is better than the state of the Union. Is that a divergence we should heed? This correction seems a nod to convention, not any doubts. How seriously should we take the selling? Waiting to see how the crowd goes.

I did establish a position in TZA 3x short the Russell 2000.

As it was, I did get the low of the day at the bell last night,

but I am going to monitor the position very carefully and

see if we get a healthy correction, or, do we go parabolic

straight up from here. Maybe AUSSIE JS can help me out today. HW

i not licenced to give advice ,Howard ,but imo look at the dax—these are topping markets and looks like instos are taking them to tops to get set on–rut is very volitile and moves come out of nowhere–rut as u know is small caps and ndx follows the dax –i think the highs are in for the day and europe closes in 20 mins–i dont know ur time frame or buffer or stops-so i leave it at that

thx AUSSIE JS (whoever you are)

im a alien

Oh boy, politics!

(snip)”Maybe it’s because our elected officials have to rerun for office every 2, 4 and 6 years…”

IMHO, I think the problem would be solved if the proletariat would arm itself with knowledge.

BTW, Zanks thinks DOW 12,000 will be shaky, but emerging with both feet firmly planted on the stairway to heaven.

I have a hard time believing last weeks pull back is the only pull back we will see over the next two months.

Neal, stay in dude, like to see your next targets of where this mkt is heading.