Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Europe is currently trading mixed. Futures here in the States point towards a moderate gap down for the cash market.

So after going almost two months without a 0.5% SPX decline, the market registered its first decent loss last Wednesday, but here we are almost a week later and there’s been no follow through and the S&P is within 5 points of its high. It’s notable the Nas and Russell are still lagging, so we don’t exactly have an “all clear” situation, yet for now, the bears are once again frustrated. Lots of warning signs persist, but for the last month they’ve been ignored. I think anything goes here, and I don’t think it’s “in the charts.” I don’t think technicals matter as much right now as they have in the past. For now I’m staying conservatively long.

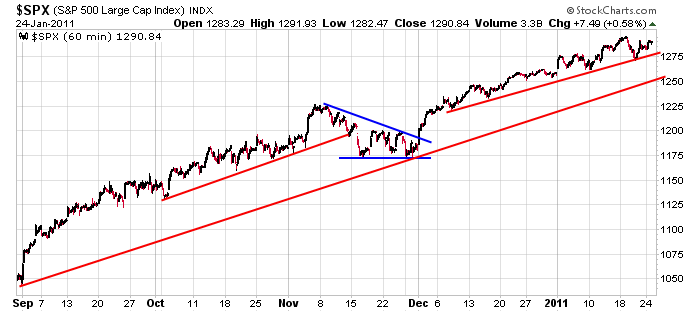

Here’s the 60-min SPX chart. The trend is up, and if the market wants to move down, 1250 is my first target.

Tomorrow is an FOMC announcement, so odds favor a slower-than-usual day today.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 25)”

Leave a Reply

You must be logged in to post a comment.

Today is ‘turn around Tuesday’ so watch the markets rise into the close.

At the bell tonight I intend to establish a base: A short position,

maybe in the Russell 2000, where I already have multiple confirmations

of a downtrend there. However, at the same time I hate chasing a trade:

(i.e., would anybody short gold at this point when it is poised for a

bounce?). So tonight at the bell I will be short in some way shape or

form and manage my positions from there. HW

From Zacks predicting 2011:

(snip)

Further growth of around 16% in earnings and 5.4% in revenue is expected in 2011. We remain on track this year to cross the prior cyclical earnings peak for the S&P 500 reached in late 2007. On a side note, the U.S. real GDP should get back to the pre-recession levels once the fourth quarter 2010 GDP report is released later this week.

of course the market is rigged,my only worry is the invissible hand of the ecb,they are desperate–with england going into negative growth for dec and another one likely and the the piigs –they may not be able to hold it–the fed is impetent

Neal thats spread betting using cfds at 100 to one leverage –short–only retailers go long and buy -hope -prey–but yes i agree with u

Howard–wise bet on the rut–now thats the real pro traders index because of the volitility

the insto use the esh1 or spx and the retailers the dji–thats why we dont want to drop the dji just yet –might frighten those dear retailers then the instos wont get set

growth–what growth in usa –earnings are rigged to beat as the instos drop expectations so as they can beat

what nonsence will the president pr tonite

(#1) AUSSIE JS : as I stated earlier I am getting sell signals

from multiple sources on the IWM. Hey Wingo Dingo, or whatever

they call you guys down under: Don’t you realize it’s easier

for the POMO to manipulate 30 Dow stocks than it is 2000 Russell

stocks. Sometimes I wonder why China only has 25 stocks in

their FXI. So as the POMO/PPT can manipulate and manipulate. HW

do you have a website?

Hi HOWARD

the pomo has a agreement with london–the ftse follows the dji futures allmost tick for tick

london controls arabia and china—the ftse is the world large caps

the agreement –london opens the usa and runs it for the first 2 hours the pomo closes it

yes im getting sell signals to but we have to get out of govt control