Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Only Japan (down 1.1%) moved more than 1%. Europe is currently mixed too. London is down 1%. Futures here in the States point towards a flat open for the cash market.

The market has had to digest a lot of stuff this week. Lots of economic numbers, lots of earnings reports, State of the Union address, FOMC meeting – through it all the market is posting decent gains. The Dow, Nas and S&P are at or very near new highs. The Russell has a little catching up to do.

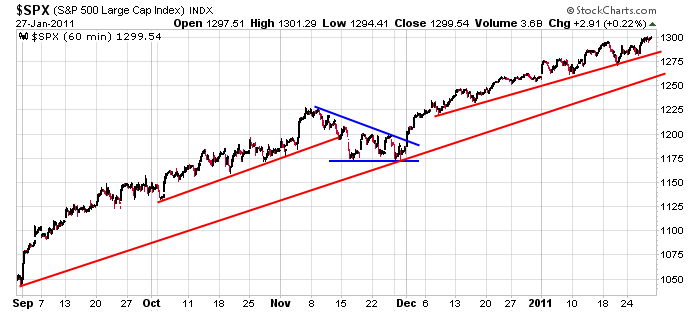

Here’s an update of the 60-min S&P chart. There’s pretty much no change. The trend rend remains solidly up, and although there have been less good set ups to play recently compared to December and last fall, there hasn’t been a reason to guess a top.

I remain long and in conservative mode.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 28)”

Leave a Reply

You must be logged in to post a comment.

DJIA is about to put in 9 weeks up.

Exceeded in 1995 with a 10 weeker.

Before that go back to 1965.

Short of gold and silver, Running light in equities. The GDP this AM is ;probably a high point for a couple of quarters.

Damn! And I was getting used to it going up.

Wow! Zacks is putting acutal numbers to their forecast.

(snip)

Everyone on Thursday was just holding their breath waiting for Friday’s GDP report. The consensus calls for 3.5%. Here is my guess of what the reaction will be.

3.2% or Below = Market sells off 2-3% over next week. Will take more time to fight back to 12,000.

3.3% to 3.7% = Market bumps around at Dow 12,000 for a while in consolidation mode. Breaks decidedly above mid to late February.

3.8% or Above = We blow through Dow 12,000 on our way to 12,300 to 12,500 before we have the next correction…which could be back towards 12,000.

That’s what my crystal ball says for now. Let’s see if I am right or need to trade it in for a better one.