Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down – China gained 1.4%, but there were several greater-than 1% losers. Europe is currently down across the board – losses aren’t too bad. Futures here in the States point towards a moderate gap up open for the cash market.

Wednesday the 19th got everyone’s attention – it was the first single day loss greater than 0.5% in several weeks. Then Friday may have broke the bulls’ backs – it was the biggest single day loss since August. Some of it was due to the situation in Egypt, so if things settle down there, the market could quickly recover. But if the situation remains or gets worse, the path of least resistance is down.

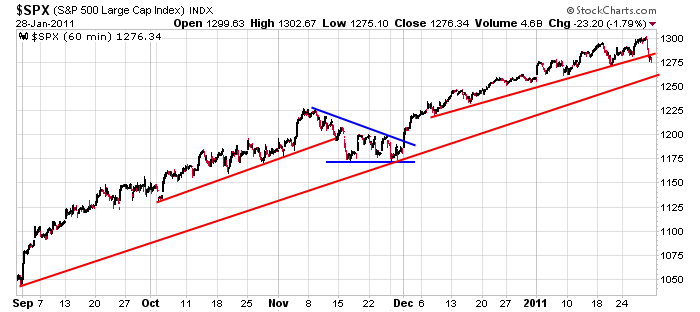

For about a month the charts and indicators didn’t matter. The market absorbed and/or ignored any divergence or thrown it’s way or any breath indicator suggesting a rest was needed. Now I’m afraid the situation in Egypt will trump the charts, so before we rush to predict how far a pullback will take the market, let’s remember Greece, Ireland, Portugal etc. didn’t ultimatley affect the market. Here’s the 60-min SPX chart. Overall the trend is rock solid; near term we could certainly pull back more and chop around. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 31)”

Leave a Reply

You must be logged in to post a comment.

I was going to move to Egypt but I don’t speak the language.

Oh well, NYC is just OK for now. It’s been a cold winter

thus far. Looking for a pop and drop at the open, and

then maybe firming up later on in the day today. HW

End of month so a little window dressing, then they must decide: to be up or not to be. I think up as risk on is favored to the end of the 15-30 of Feb. After that they sweat the end of EQ2. Can we live without a weekly hit??

My silver trader is saying the unrest in Egypt is going to spread, buy! buy! buy!

This is from iVolatility.com (snip)

S&P 500 Index (SPX) 1276.34. From hero to zero in one day as the SPX made a Key Reversal, defined as a higher high for the trend, but a lower close, Friday trading up to 1302.67, as new high for the current trend and then reversed to decline as low as 1275.10 before closing just off the low at 1276.34. The significance of this minor trend change indicator is that it forecasts a lower low the next trading session. There are two caveats to remember about Key Reversals. The first is the requirement for higher than average volume and Friday’s SPDR S&P 500 Index (SPY) 127.72 volume at 296 million shares, the highest volume since last November 16 at 300 million, qualifies as high volume. The second requirement is for a decline open interest in S&P 500 e-mini Futures contract and based upon the preliminary numbers from the CME open interest actually increased. We have more in the e-mini section below.

E-mini S&P 500 Futures (ESH1) 1271.50. Friday’s preliminary volume at 3.2 million contracts was certainly high; in fact, it almost qualified as blowoff volume, which we estimate to be over 3.5 million contracts. But, the preliminary CME open interest numbers do not support the Key Reversal view since they were reported to be up 66,755 and we know not to trust a key reversal if open interest increases. However, the preliminary numbers are subject to final revision, which could be dramatic, and enough to show open interest declined thereby indicating long liquidation. Until the open interest numbers are reported on Monday morning, the Key Reversal in the e-mini is uncertain.

My post from 8:48am today was dead on.

Hey Neal, when you get back to Chicago

go to Walgreens and buy ‘Soap on a Rope’

HW