Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed and with a slight bearish bias. Europe is currently mixed. Futures here in the States point towards a small gap down open for the cash market.

All the indexes made new highs yesterday…the divergence between the S&P large caps and Russell small caps is no longer. But along with a strong market the last week comes the strongest breadth indicators in a few weeks. If the market’s strength was measured by the number of S&P 1500 stocks above their 10, 20, 30 and 40-day MAs or by the number of stocks making new 10 and 20-day highs, the market is as strong as it’s been at any time the last two months. Strong internals within an uptrend may lead to a little give back in the near term, but overall should lead to new highs down the line.

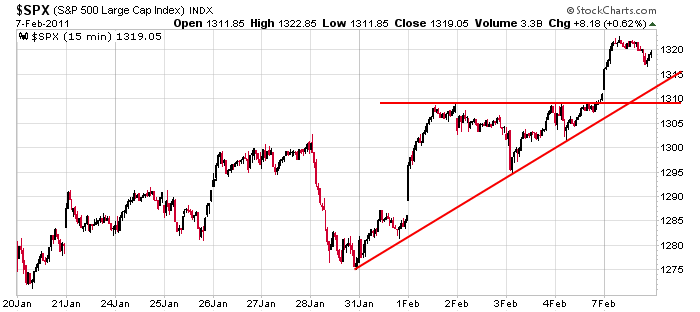

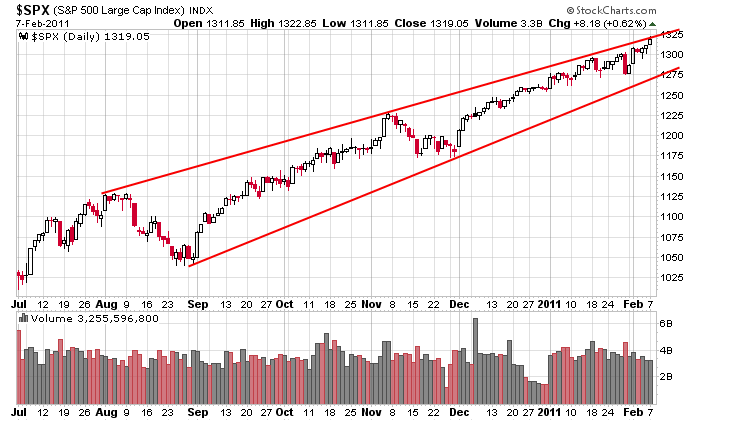

Here are the 15-min and daily S&P charts. If the market wants to pull back for a day or two, 1310 is my target. If it wants to pullback for a week or so, 1275 is my target.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 8)”

Leave a Reply

You must be logged in to post a comment.

China raises bank rates to fight inflation last night. It may mean that China does not grow at 10% this year, but it will grow and its demand for commodities will also be relatively stable.

But Europe is not cheered by the news, and Lacker says the Fed should review the need for QE2. That has our plungers nervous. Love that liquidity. I think nothing changes until June.

A cycle turn date is due about 2/17, could come early, Since it is a Bradley standard, it has no polarity, just a change in direction. I think a gradual correction is due.

Still long this AM. Long dollar, RSP and selected ETFS in my relative strength play which since last Sept has average about 28% on the up side.

You can’t put a Volkswagen into a Cadillac and vice-versa.

I would pay attention to what Whidbey says about the

Bradley model turn cycle date due next week. HW

ur right ,Neal not to many left and Whidbey next week could be deadly

not many want to talk about the true cause of the turn –eem

the retailers talk about trend,but we all know its the big instos that create the trend and/or change

the banks own the central banks and the fed does the banks bidding–the fed has been pumping the markets and right now the instos are selling strenght and hedging for a downturn possibly lasting for a long time and the retailers all all long and hedged with calls ect

i think u all get the pitcher–the big boys know the game is almost over world wide–new fed members anti fed new pollies -austerity–riots in the streets –soverign debt forcing banks to raise capital and no more bailouts

oh well who cares

…and, TiVo makes it surreal.

Hey Aussie JS You know I respect your opinion, but the fact that you come from the land down under, what makes you such an expert on U.S. market affairs and the like? Are you working for the Obama administration in some secret capacity we all don’t know about? (sounds like a movie plot, don’t it?)

That’s arrogant, with that logic how would an American understand the Chinese market.

hey Howard

im a nomad–our market is to small to trade–slow and about 40 points if that a day–so i sleep days and trade from 6pm our time europe open to 7am our time usa close

Hey Aussie Joe…Where are you Exactly ??