Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down – there were several 1% losers. China is finally trading again. Europe is currently trading mostly down. Futures here in the States point towards a moderate gap down open for the cash market.

By certain measures, yesterday was as strong of a day as we’ve had in a couple weeks. 504 of the 1500 S&P 1500 stocks closed in the upper 10% of their intraday range. A number this high has been registered twice this year – once in the days before the Jan 19th sell off and once before the Jan 28th sell off. The number of stocks closing in the top 20% and 30% of their intraday ranges also hit their highest levels in a couple weeks. Throw in the S&P’s winning streak (up 6 of 7 days and 11 of 13) and the recent declining volume, and the stage is set for a some give back.

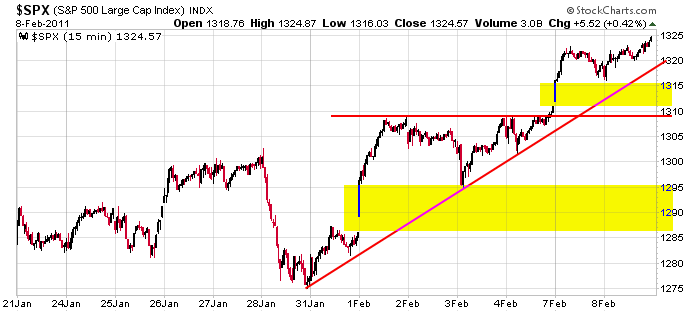

I’m long and other than the great performing metals stocks (see AVL yesterday) I’m not looking to enter new positions right now. If the market decides to pull back, my short term S&P target is the same as what I stated yesterday – 1310. Here’s the 15-min chart.

As stated yesterday, don’t over analyze a market which isn’t adhereing to the normal ‘stuff.” The trend is up, go with the flow. Just make sure you know what your anticipated holding time is before you enter. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 9)”

Leave a Reply

You must be logged in to post a comment.

Bernanke Day, the markets grovel at the man’s feet and congress can not lay a glove on him.

Beware the trend and use tight stops, even Ben does not know what he will say or how it will be understood by the market. No way of knowing if he has any credibility left. Remember the day he said we have never had a housing decline nation wide. So much for his history understanding.

Watch silver it seems to have the juice to move to the 30s. NGas is some price action, might be a play watch UNG.

Heavy selling in Asia overnight: HSI and Shanghai. Same with Brazil: correlation of markets is mounting?? That means demand for oil, metals and technology in China and India are likely to decline.

I forget to take my meds this morning. Barely remember Zorro, but if you say so,

Neal ,I’ll take your word for it. Q. Do we see market divergence soon, or does

everything go straight up in parabolic fashion? I am watching SMH to reverse

course and implode inverse to the way it has gone up. HW

The Asian/Pacific markets especially India is indicating more weakish trend for NIFTY -It has given a weak closing at 5253.5 If staying below 5304.3 , it may test 5251.5 and even 5155.8 however staying above 5304.3 it may go to 5401.2 this is what Indian market research analyst is estimating